CenPOS enables direct connection to Visa for merchants by certifying with the Visa Accelerated Connection Platform

CenPOS enables direct connection to Visa for merchants by certifying with the Visa Accelerated Connection Platform

Miami, FL (PRWEB) April 07, 2015

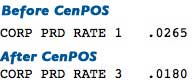

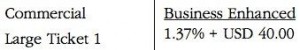

CenPOS, a payment technology provider, announced today that it has certified to Visa Accelerated Connection Platform (ACP). These continued efforts enable CenPOS merchants globally to take advantage of Visa’s transaction authorization and capture services, end-to-end encryption, tokenization and integrated redemptions; thus, bypassing the existing core bankcard processors for these and future Visa services. This connection not only enables merchants to connect to more than 2 billion Visa cardholders worldwide, but also connects them directly with the rest of the card brands as well. A direct connection to the card brands creates value and reduces PCI cost for merchants by encrypting data at every point of the transaction. More importantly, merchants now can leverage Visa’s technology infrastructure and achieve better financial results while providing their customers with an enhanced payment offering.

“We at CenPOS believe that this new connection creates significant value for our merchants and gives them the control they have been seeking for years, especially their ability to freely choose financial providers without the fear of any business disruption and/or changes in their daily workflow. It makes business and financial sense for merchants to go directly to the card brands and bypass their acquirers for these services,” said Jorge Fernandez, CenPOS’s Co-Founder and Chairman. “We at CenPOS are always on the cutting edge of payment technology. As evidenced by our recent EMV certification in the US, we are committed to delivering innovative solutions for our clients globally”, added Fernandez.

About CenPOS

CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS’ secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships. For additional information please call 877.630.7960.