One of the first banks to directly embed its own payment tools within Microsoft Dynamics 365, U.S. Bank delivers easy-to-implement, efficient payment capabilities.

MINNEAPOLIS (October 31, 2022) – U.S. Bank has embedded payment solutions within Microsoft Dynamics 365, the first of a strategic collaboration established to embed U.S. Bank payment capabilities across Microsoft platforms. The integration helps meet businesses where they are, with secure, fast and easy-to-implement payment capabilities.

U.S. Bank is one of the first banks to embed its own payment tools directly within Microsoft Dynamics 365. The direct integration into the enterprise resource planning (ERP) and finance solution makes it easier for businesses to click and start using the capabilities quickly. U.S. Bank has several more capabilities in the pipeline to embed additional payment tools within workflows across Microsoft platforms including Microsoft Teams and Microsoft Power Platform.

“We are committed to meeting clients wherever they are in their digital journey, bringing payments to businesses in a way that’s instant, embedded and connected to the technology they use every day,” said Shailesh Kotwal, vice chair and head of Payment Services, U.S. Bank. “Our integration with Microsoft – which businesses rely on daily to serve their customers – opens new possibilities for U.S. Bank clients to improve efficiencies and enable faster payments.”

“Embedded payments can deliver powerful, new ways for businesses to streamline processes, enhance visibility, deliver better experiences, and reduce risk,” said Bill Borden, Corporate Vice President, Worldwide Financial Services, Microsoft. “We are excited to build on our work with U.S. Bank, delivering integrated, easy-to-use digital payments capabilities to our customers through Microsoft Dynamics 365 with additional embedded solutions to come.”

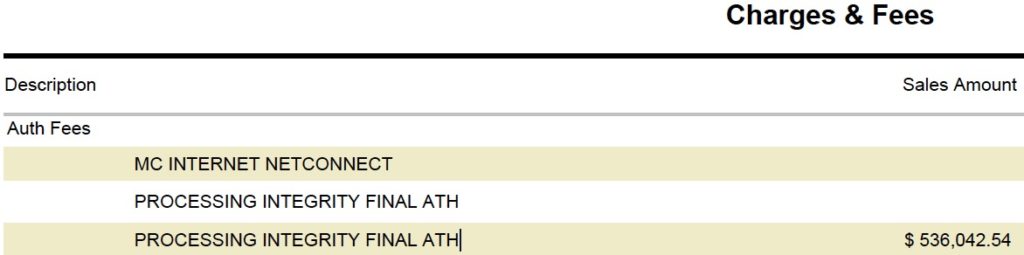

Businesses using Microsoft Dynamics 365 can now easily use U.S. Bank AP Optimizer® directly from their business application. This will enable treasury management departments to automate invoice processing for business and consumer payment disbursement within Microsoft Dynamics 365. The solution allows for automated accounts payable workflows, including matching and reconciliation.

With Elavon’s Payment Gateway also now available to use within Microsoft Dynamics 365, businesses can easily enable a secure and end-to-end accounts receivable payment solution with their ERP. Directly integrated with the payments journal for accounting within Dynamics 365 Finance, the solution helps companies automate more of the accounts receivables process, speed up collections through multiple payments acceptance channels, and reduce errors.

Contact:

Todd Deutsch, U.S. Bank Public Affairs & Communications todd.deutsch@usbank.com | 612.303.4148

About U.S. Bank

U.S. Bancorp, with approximately 70,000 employees and $601 billion in assets as of September 30, 2022, is the parent company of U.S. Bank National Association. The Minneapolis-based company serves millions of customers locally, nationally and globally through a diversified mix of businesses: Consumer and Business Banking; Payment Services; Corporate & Commercial Banking; and Wealth Management and Investment Services. The company has been recognized for its approach to digital innovation, social responsibility, and customer service, including being named one of the 2022 World’s Most Ethical Companies and Fortune’s most admired superregional bank. Learn more at usbank.com/about.