Upgrading from Dynamics AX to D365 Finance & Operations?

Consultants help with planning and migration, however, when it comes to choosing a payment connector to capture revenues, engaging a payment processing professional can save boatloads of time and money. Why?

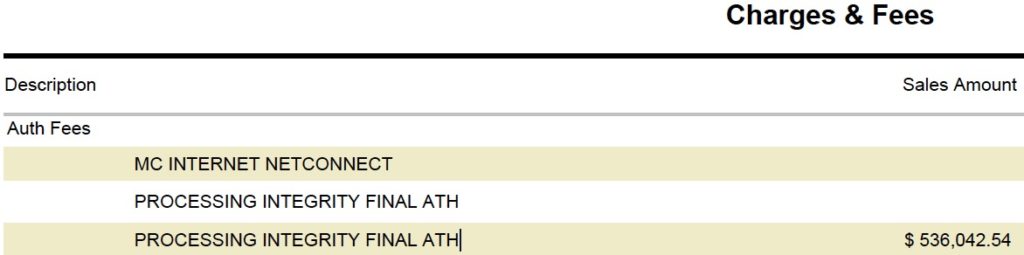

- The payment connector, including payment gateway, influences credit card processing fees. Compliance with authorization and settlement rules is complicated and connectors manage processes differently because of where they are in technology development. It’s the single largest influencer of fees and penalties you’ll pay. Look at this MasterCard Integrity Fee on a Chase Paymentech merchant statement:

$536,042.54 multiplied by a .25% penalty fee for a total of $1,340.10 in avoidable costs. This is due to not properly authorizing and settling transactions, including reversals for unused authorizations. There are many ways to get authorization penalty fees and I’ve written multiple articles about them, including this on the Visa Stored Credential Mandate.

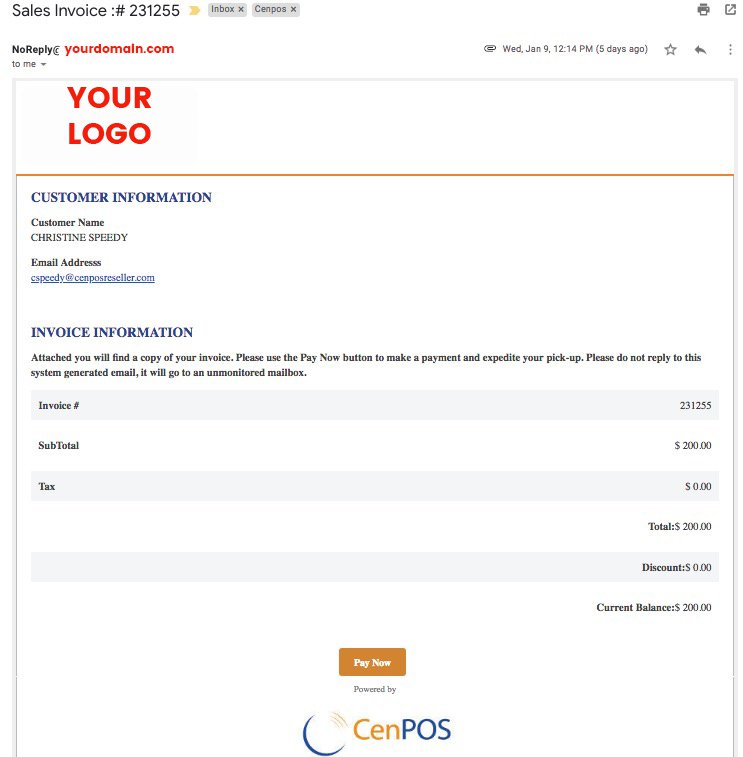

2. The payment connector makes a huge difference in internal automation for related processes, such as updating journals, as well as external customer automation including self-service access to invoices, payment history, managing payment methods and more.

3. The ISV payment connector package may include other items in your development road map. An independent payment processing professional will assess needs and provide insights on multiple connectors to help guide your business to the best choice. Which support the stored credential mandate for unscheduled credential on file? How will it help meet current and future Covid-19 side effect needs? How will it protect the business from a data breach as a result of workers at home?

In my experience, consultants don’t consider the payment connector until the project is defined and well under way, a contributing factor why more than 50% of ERP implementations fail to meet time, budget, or benefit objectives. Specification decisions are based on ‘securing payments’, without knowing how the connector might already have built-in solutions for other areas including customer service, sales, accounting, call center and more. If brought in sooner, the payments professional can eliminate some customization, reduce implementation time and costs, while improving immediate benefits.

To summarize, a flip phone and a smart phone are both capable of making phone calls, but the experience is completely different. Which would you prefer?

Christine Speedy, 3D Merchant blogger and CenPOS Global Sales, 954-942-0483 is an Independent Payments Professional and is independently Qualified Integrator Reseller (QIR) certified by the PCI Council.