Merchant statement review, partial statement shown.

Did you get a call from sekurecostreview.com for a merchant statement analysis? Read my research, which points out why I recommend merchants never give this company merchants statements or any other business information. 3D Merchant Services has no affiliation with this company but was hounded by endless phone calls from them so I decided to research them and share what I learned.

The company web site is here: http://www.sekurecostreview.com, but they have more web sites with the same physical address.

Who is Sekure Cost Review?

sekurecostreview.com affiliated web sites:

-

-

Sekure Card Services – sekurecardservices.com

-

Sekure Merchant Solutions sekuremerchants.com

- Sekure Careers sekurecareers.com – they hire telemarketers

The address is 1501 Broadway, 12th Floor, New York, NY. The address is not a traditional office, but one where anyone can ‘rent space’ so that they have a ‘prestigious office address’. From www.newofficeamerica.com, “This modern, professional business center offers companies a prestigious corporate address right at the heart of Times Square on bustling Broadway, your clients won’t help to be impressed.”

US Business Affiliation?: There’s no business registered in NYS with any of the business names in the domains above. Further, past employees report that the company is actually based in Montreal Canada, even though they called exclusively on US based businesses.

“When I can’t find a business registered with the state their supposedly affiliated with, I won’t do business with them,” says Christine Speedy, 3D Merchant Services.

The Sekure Cost Review sales pitch:

The caller said that she was providing a free cost review “funded by major banks, processors” and others in the industry. That perked my ears. Who was paying for it? I wasn’t able to get a straight answer other than the big banks etc and they may change from time to time. “Are you a processor or ISO?” “No, we’re a broker. We save you…” . I asked it they were a lead generation company for processors? “No.” From my research and industry knowledge, in my opinion, they’re conducting lead generation which they then send to ISO’s, or independent sales organizations, and then they get paid for deals. That’s pretty common.

The pitch is that by providing merchant statements they’ll give a side by side comparison so that I could see if I was getting gouged. No obligation.

Statement reviews are a good idea when lacking technology know to reduce their usefulness. Sekurecostreview.com and affiliated web sites highlight four items about their business:

- BBB reputation: USA media has proven there’s little value in a BBB reputation since companies can BUY their reputation, and there’s no verification. (See 20/20 report among others.) All sites link to Sekure Merchant Solutions, a company potentially not even legally registered in NYS. Additionally, there are 32 complaints, and while nearly all were resolved, this number is much higher than companies in the same industry that are bigger by volume processed and number of merchants served.

- Low cost rates: The web cites $30M/mth and the phone called cited $40M/mth in transaction volume as the reason for their great rates. In my opinion, while it’s not insignificant, companies with $100M/mth or more are far more likely to have better options.

- POS: Reprogram or Free terminal. Free terminals are nearly always bad because the money has to be made up somewhere. That means possibly older but PCI compliant equipment, but more likely higher fees to cover the initial outlay, or long term contracts with heavy contract dissolution fees to get out of them. All merchant agreements include future fee increase clause so at some point you’ll pay a lot more for free equipment.

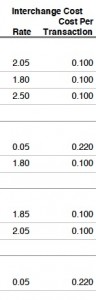

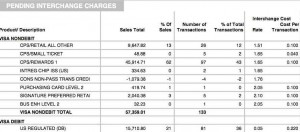

- Sample Review: Looks like a pretty typical side by side review that takes the same transactions at the same interchange qualification and applies a different discount rate. Rate comparisons can be a terrible way to make merchant process choices.

- Interchange management can reduce fees from .10% to over 1%. That’s above and beyond any discount fee negotiation. There’s a bottom to discount fee negotiation- then what will you do to reduce fees?

- Improved productivity can increase EBITDA significantly

- Reduced PCI compliance burden increases productivity in other areas of business.

- There’s other tools that reduce fees even more and shift fraud liability risk to issuer.

Bottom line: As processor profits are narrowed, the bigger merchant savings comes from better interchange rate qualification in addition to efficiency improvements and reduced PCI Compliance burden.

Other:

Allied Memberships: What does ‘allied’ mean? It does not mean an endorsement. For example, the NRF offers Retail, Service Provider, and University memberships. The only membership sekurecostreview.com qualifies for is Service Provider. I didn’t find their company in any of the online buying guides. That doesn’t mean they’re not a member, just not in any area I searched online.

Is sekurecostreview.com a scam or legit?

They may or may not provide a valuable service to some merchants, but the negatives far outweigh the positives. Sharing highly confidential information in a world of escalating identity theft is just not worth the risk.

How can I stop Sekure Card calls? That’s a touch one because they may spoof phone numbers and or block caller ID.

- Add your business telephone number to the National Do Not Call Registry through the federal website. After 31 days you can report them. Most phone calls to a business made with the intent to solicit sales from that business are exempt from the Do Not Call provisions, but if enough people complain, maybe they can help.

- You could also write your Congressman and Senator that the current rules are outdated. (And why should be we subjected to 1,000’s of political calls with no opt-out method either?)

- Anyone want to start a petition? https://www.change.org/start-a-petition/entry?source_location=blank_source___exp_us_expert_support_v1___sap_entry

What’s the alternative? Just about anyone can provide a statement review. Find someone that knows about your industry and asks questions about your business without sharing merchant statements. It takes more time and expertise to get through these steps, but it’s a lot safer. Avoid choosing any vendor that has a web site without identifying an owner or single person by name. Look up the salesperson on linkedin.

See Christine Speedy on Linkedin and see Christine Speedy on 3D Merchant Services. You can also look up 3D Merchant Services in the official Florida registered businesses. At least you’ll know it’s real.

Disclaimer: This review contains information that may become outdated. It was accurate at the time written based on publicly available information.

Update 12/10/2018. I just got a call from Sekure at 800-915-0927:

Sekure: “Christine, I’m following up on my prior call with a Sekure colleague a couple months ago. It looks like the only thing missing from our being able to complete the analysis is your merchant statement.”

Christine: “Please remove me from your call list.

Sekure :”Well I don’t know why you wouldn’t want the free analysis.”

Christine: “It’s not up to you to decide whether I want your calls or analysis. I’m telling you to remove me.”

Sekure: ” OK, will do.”

The above is not an exact quote. Hopefully the calls will stop!

Reviewed by Christine Speedy, PCI Council QIR certified. To reduce merchant fees with new or existing merchant account call 954-942-0483, 9-5 ET. CenPOS Global Sales authorized reseller based out of South Florida and NY. CenPOS is an integrated commerce technology platform driving innovative, omnichannel solutions tailored to meet a merchant’s market needs. Providing a single point of integration, the CenPOS platform combines payment, commerce and value-added functionality enabling merchants to transform their commerce experience, eliminate the need to manage complex integrations, reduce the burden of accepting payments and create deeper customer relationships.