Consumers save time by making online and in-lane payments directly through Xtime

REDWOOD CITY, Calif., Oct. 17, 2019 — Dealers using Xtime can now leverage the payment processing capabilities of CenPOS, which is now part of Elavon, to customers creating an enhanced vehicle ownership experience through quicker online and in-lane payment options.

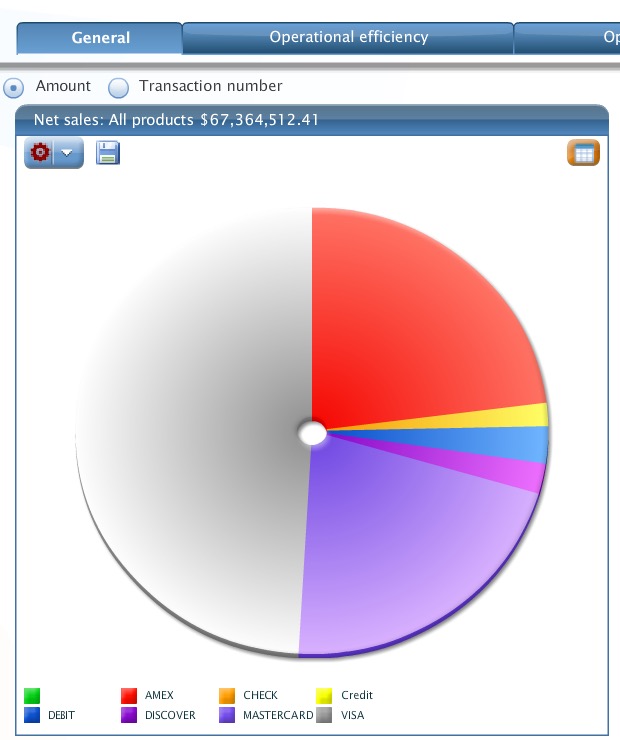

The CenPOS payment solution integrates into Xtime’s Spectrum Platform, which makes it easier to capture and report customer payments efficiently either in the service lane from a tablet device or any service department workstation. All U.S. and Canada-based franchise dealership customers can immediately use the CenPOS payment functionality, creating more convenient, reliable payment options without requiring a significant investment or process change.

“Giving our service advisors the ability to own the experience from start to finish on one platform is pivotal in the way we intend to do business in the future,” said Chance Wiseman, fixed operations trainer at Del Grande Dealer Group in San Jose, Calif. “This one key change in technology will drastically streamline the active redelivery process. Another opportunity Xtime is providing us to exceed our customers’ expectations.”

CenPOS provides dealership customers with more control over their experience. With the choice to make payments remotely thorough their computer and smartphone, or onsite at the dealership with the new and improved Xtime Engage Tablet Reception application, customers can pay as they choose.

“Dealers should look at the service experience they are offering their customers in order to drive greater customer loyalty and retention,” said Tracy Fred, vice president and general manager of Xtime. “The powerful combination of CenPOS and Xtime’s single platform gives both service management and advisors a more streamlined and easy-to-use solution that meets consumers’ demands and saves them time and energy throughout the entire service experience, from write-up to payment.”

An efficient check-out process is also critical to keeping consumers happy and coming back. Consumers who are most satisfied spend 2.5 hours or less at the dealership for service.1 As a result of this new integration, dealers interested in using Xtime’s Engage payment solution will soon have their choice of multiple merchant processing providers.

“With extensive expertise in providing payments for the auto industry, together with Xtime, we can offer rich, secure solutions that are specific to the needs of this industry,” said Joey Orozco, director of business development, CenPOS. “By streamlining service check-out, dealerships can increase customer satisfaction and save their customers valuable time.”

For more information, click here.

1 2019 Cox Automotive Service Industry Study

About CenPOS:

CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS’ secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.

About Xtime

Xtime increases customer retention for automotive dealer service departments by using technology to transform the ownership experience. Improving customer satisfaction and retention drives dealer revenue and profitability. Xtime is committed to delivering the experience consumers demand – an experience which emphasizes value, convenience and trust.

Xtime books 52 million service appointments and processes 120 million repair orders annually. Twenty-nine global OEMs have chosen Xtime to drive that same type of success for their businesses, converting more than $13 billion in service revenue annually for more than 7,500 dealerships.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 34,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with revenues exceeding $20 billion.www.coxautoinc.com

Credit card fraud is still rampant in the US, even after US EMV liability shift convinced many merchants to purchase terminals to support chip cards. Marine, auto, and other high value parts dealers have long had a problem mitigating fraud risk with local and international parts.

Credit card fraud is still rampant in the US, even after US EMV liability shift convinced many merchants to purchase terminals to support chip cards. Marine, auto, and other high value parts dealers have long had a problem mitigating fraud risk with local and international parts.