Prestige Software’s main product Cloud Hospitality, the channel management software to the travel industries biggest consumer buying web sites, including Expedia, Hotels.com, and booking.com left data exposed for over 10 million log files, dating all the way back to 2013. At the November 6, 2020 breaking news, it was not yet known whether the data left open on a server was stolen or not. However, we know that criminals run scripts looking for data all the time so it won’t be a surprise if there was a breach.

A channel manager is used to manage bookings across multiple webs sites, including hotels and restaurants. For example with vacancy management, if there is one room left and someone buys it on booking.com, it will show unavailable on hotels.com. With millions of records exposed around the globe, there is sure to be fall out.

Because both personal and credit card data was exposed, I recommend consumers change their travel web site passwords, email passwords, and keep an on on credit card usage or set up alerts.

The data contained full card data and the security code. It’s a PCI Compliance and card network violation to store sensitive cardholder data, therefore, they could lose the ability to store, transmit, and handle all credit card data. While the booking platforms did not expose the data, there is certainly a weakness. For more information from the team that broke the news, see https://www.websiteplanet.com/blog/prestige-soft-breach-report/.

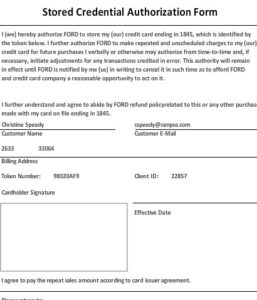

This incident demonstrates your security is only as good as your weakest link. What actions have you taken to remediate deletion of old records both paper and digital? What about your partners? I know of multiple solutions providers that enable merchants to create their own digital credit card authorization forms. This form is then reviewed or downloaded by an employee, with card data key entered then into some other system by the employee. There are so many things wrong with this, including the signature is not even a valid form of defense for card not present. 3-D Secure is the way to go.

- If your company uses a 3rd party for billing and or collections, ask questions.

- If you’re not using updated tools to keep card numbers out of employee hands, hardware and software, you’re at risk.

- Remember, if cardholder data can be decrypted and viewed, you’re at risk.

- If you can see the full card number and security code after authorization, that is not compliant.

Contact me for a FREE checkup for common problems IT and security professionals might miss.

If your company has card data that can be retrieved and viewed, you’re at risk too. I fix that.

Christine Speedy, Founder 3D Merchant Services, QIR certified, is a credit card processing expert with specialized expertise in card not present and B2B payment processing technology. Less than 1% of all merchant services sales representatives are QIR certified by the PCI Council. Christine is an authorized independent sales agent for a variety of merchant services and payment technology solutions.