Accountants offer professional advice regarding cash flow, accounts receivable, tax preparation and all sorts of other consulting. Credit card processing and all the compliance it encompasses introduced immense new compliance challenges in 2017, and it’s fair to say, most businesses have no idea what they are, or what the repercussions are. A big problem is people think it’s someone else’s responsibility to keep their business compliant. Every single merchant must make internal changes to comply.

Three things every B2B company needs to know about credit card processing right now:

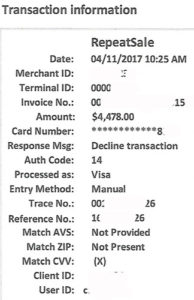

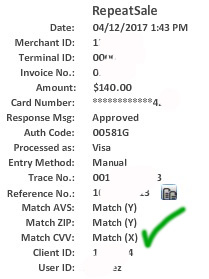

- If you store credit cards, you must be compliant with Visa Stored Credential Framework. This is arguably as huge as the retail shift to EMV chip card acceptance. There are significant financial and risk consequences for non-compliance. Some solutions companies reduce the compliance burden more than others, while maximizing profits and cash flow.

- PCI Compliance mandate for TLS disablement will disrupt business, mostly starting right now, February 2018. Businesses need to ensure they’re servers, software (if applicable) and browsers are compliant, and also have an plan to help internal and external customers overcome issues trying to login to portals, make online payments etc.

Why these 3 things? Because 100% of B2B companies I talk to will fail on at least one, and usually two or three. That includes CPA firms also. 86% of all data breaches in 2016 were from level 4 merchants, defined as

Example of solutions to solve these problems:

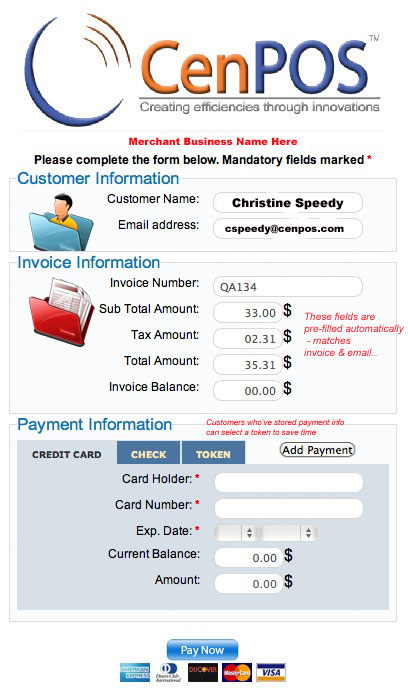

- An intelligent payment gateway can automate compliance with many elements of the Visa Stored Credential Framework. Simply passing data as most payment gateways do is not enough.

- Engage internal or external IT team to test all systems for TLS compliance, and verify at SSLlabs.com.

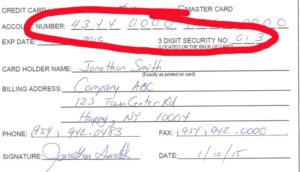

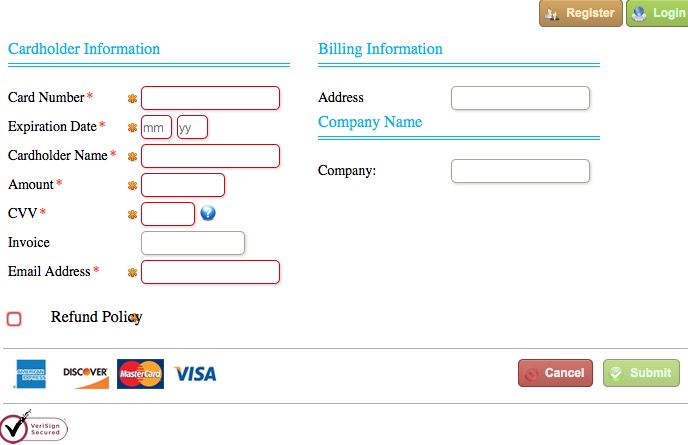

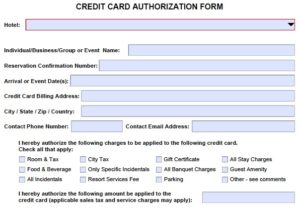

- Empower customers to self pay via push (text or email), or pull (online hosted pay page) technology so that employees never have access to cardholder data again. Whatever the old justification for using paper forms with full card data, there is a technology solution that has negated the need.

Christine Speedy, CenPOS authorized reseller, 954-942-0483. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.