Microsoft Dynamics AX credit card processing integrated for maximum profit and maximum security with Validated Point to Point Encryption (vP2PE).

PCI Compliance is a moving target. We help reduce compliance burden with a PCI validated Point to Point encrypted solution. It’s important to note that only non-validated P2PE solutions have experienced data breaches in the last 12-18 months.

- Accept credit, debit, ACH, check with guarantee, cash, wire, Paypal and more payment types.

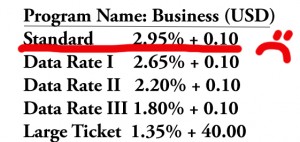

- Smart Rate Selector reduces credit card processing fees, including with level 3 processing. Qualifying transactions for the lowest rates is complicated and only with dynamic rules management can merchants automate processes that impact fees.

- Flexible processor options. You choose. Whether you want to keep your existing First Data, Chase Paymentech, Worldpay, or any other provider, or make a change, we give you options. And if you change acquirers in the future, it’s non-disruptive to operations, unlike “all-in-one” solutions.

- Need to reduce compliance scope for card not present transactions? Our Encrypted Virtual Keypad segregates your hardware from scope.

- Compliance with new stored card credential rules is complicated also. We reduce compliance burden with various configurable tools.

Do you have DOPS transactions currently processing credit cards?

You cannot process (authorize, capture, void, refund) any transaction through Dynamics online after Dec 31, even if that transaction occurred prior to Dec 31. After 12/31/2017:

- Credit cards linked in AX – Will no longer work for any connector, need to be deleted and re-entered.

- Authorization – Will be lost. Either process this through your new solution or work with the payment provider to capture an existing authorization if possible.

- Capture – Will not be able to process linked refunds.

- Void – Will not be able to void a payment.

- Refund – Will not be able to refund a payment.

The above transaction types are very limited. For example, re-authorization, incremental authorization and authorization reversal are common types of transactions in B2B. If not managed correctly, then merchants pay higher fees and risk chargeback by both issuer or customer.

Headquartered in Miami, Florida, CenPOS is reshaping the future of commerce through technology innovation and the secure, flexible and simple solutions this enables. Christine Speedy, CenPOS Global Sales, 954-942-0483 has extensive B2B experience to help any business understand risks and benefits of alternative cloud solutions.