Need a solution to process credit cards for Microsoft Dynamics AX 2012? Whether replacing Microsoft Dynamics ERP Payment Services due to end of life announcement, or looking for an alternative to Red Maple Advanced Credit Cards, Christine Speedy has a solution to delight your customers and make your business more profitable virtually overnight. It’s wrong to thing big name gateways are compliant with your B2B payment processing needs. If that were true, our solutions would not exist.

Dynamics AX Credit Card Processing Critical Features Checklist:

- Customer managed wallet from the very first sale, including before payment is needed. Must eliminate need for paper or digital credit card authorization forms with card data in the clear!

- No 3rd party applications needed to get paid from invoice; automate journal entry updates. (Eliminate BillTrust and similar.)

- Communicate the way your customers want, both text and email.

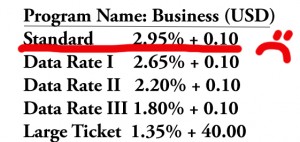

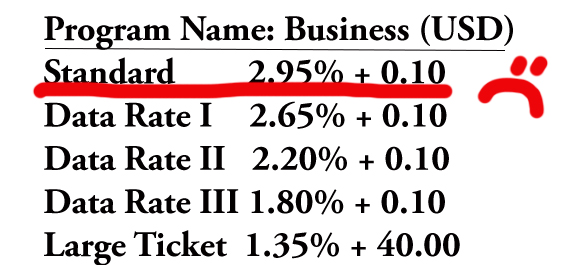

- Automate rate qualification. A payment gateway with Level 3 processing is not enough; merchants can only qualify for level 3 (corporate, purchasing, business card) interchange rates if all the rules are met. The two most common rules B2B businesses struggle with are “Settlement within 72 hours” for card not present sales, and “Authorization amount and settlement amount must be equal”. CenPOS automates compliance, most gateways cannot.

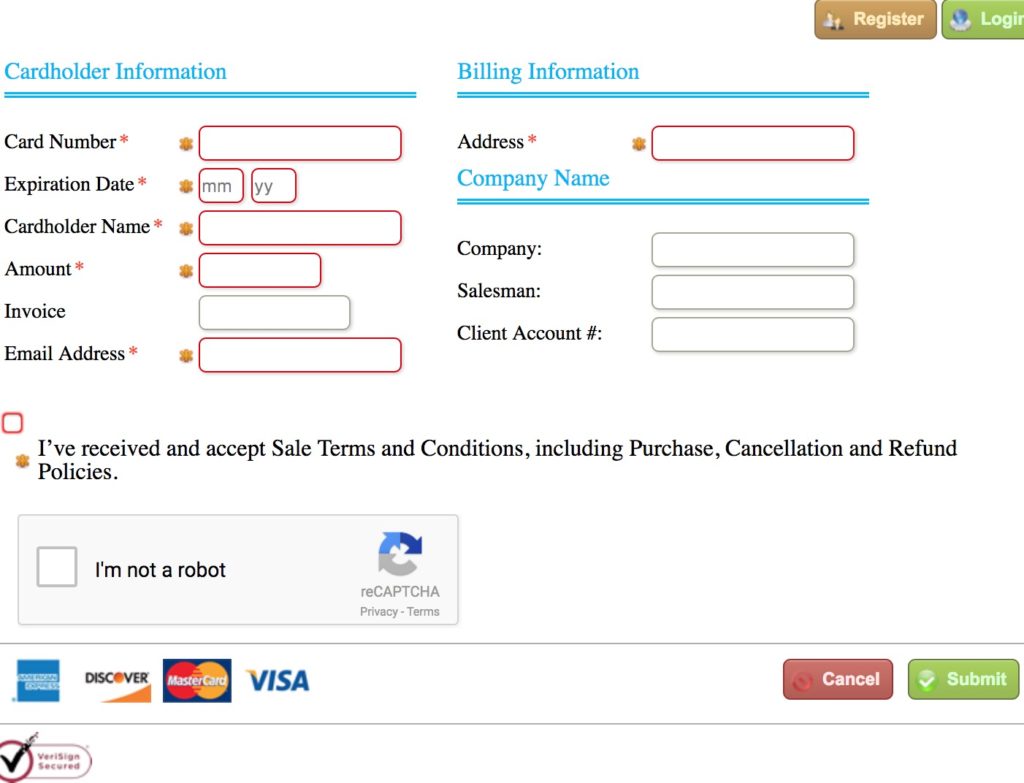

- Compliance with Visa Stored Credential Transaction framework and mandates effective October 14, 2017. Merchants need record of customers opt-in to storing and use of the stored card terms and conditions, among other items. For example, a checkbox. There are many nuances including identifying merchant initiated vs customer initiated. CenPOS automates compliance, most gateways cannot.

- 3-D Secure cardholder authentication- increase approvals, shift fraud liability risk, and for some card types qualify for reduced interchange rates.

- Virtual Encrypted Keypad – segment your network, software and devices from payment processing for reduced PCI Compliance scope and burden.

- Accept payments wherever you need in AX- free text, sales orders, payment journals and more.

Improve Efficiencies, Cash Flow, Customer Experience:

- Invoice delivery via text and email

- 2-clicks to pay for repeat customers

- Customer managed wallet for payment methods.

- Invoice portal – on demand access 24/7 to view and pay invoices

- Automated collections reminders to pay

AX Solution for all payment types:

- ACH and check, with and without guarantee.

- Wire- eliminate inefficiencies matching deposits to invoices and returning unidentified wires.

- Credit card

- Paypal and more

Depending on your current AX set up, businesses can be live in less than 2 days.

Christine Speedy, CenPOS authorized reseller, 954-942-0483. B2B cloud payments solutions and CenPOS enterprise cloud payment solutions expert. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.