Looking for a level 3 processing gateway?

No new merchant account required with our omnichannel payment gateway that works with your existing financial partners. Contact us for a free Magento gateway module and your business to business company can start qualifying for lower interchange rates almost instantly.

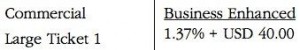

Example of a low level 3 interchange rate a merchant transaction qualified for. Without our solution, the qualified interchange rate would have been more than double.

Key things to note:

- Level 3 processing for all major processors

- Omnichannel – from retail to hosted pay pages to Electronic Bill Presentment & Payment, level 3 is supported all sales channels.

- To qualify for level 3 interchange rates, any initial pre-authorization and settlement must be equal, and there must be a valid authorization code (not expired), in addition to other requirements. It’s here where most other solutions fail, even if they do support level 3.

Level 3 payment gateway are modules available for Prestashop and other shopping carts too. Contact Christine Speedy at 3D Merchant Services