Recurring CoF monitoring is related to merchants using stored cards on file for recurring billing. Merchants are getting notices from acquirers about failing MasterCard Data Integrity reporting and, from what I’ve seen, only have two weeks to correct the issues.

The below merchant has been identified by the latest MasterCard Data Integrity reporting as failing Edit 21 – Recurring CoF Monitoring. Per MasterCard, all recurring payments are considered credential-on-file transactions. MasterCard requires POS entry mode= 10 (credential-on-file) to be sent for transactions identified as recurring. Please work with the POS vendor and these locations to correct the POS entry mode. If corrections are not completed, merchants are subject to non-compliance assessments and fines will be allocated.

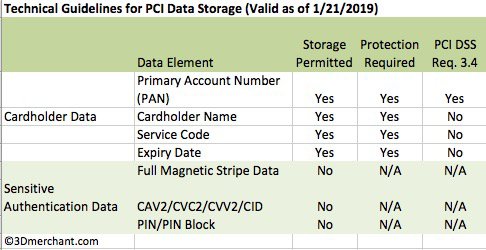

Basically, a merchant must comply with rules about how a transaction is presented to the acquirer and the issuer for authorization. The payment gateway is largely in control of sending the correct data with each transaction. In the example violation notice, the merchant is not compliant with recurring payment rules which requires specific steps when storing a card for the first time and then for ongoing payments.

The 3Dmerchant.com blog has many articles about the Visa Stored Credential Mandate. Visa’s are the most stringent and by following them, merchants will also be compliant with MasterCard’s. The rules went into effect in October 2017, with enforcement delayed to May 2018. Despite some claims to the contrary on payment gateway web sites, the mere fact that a payment gateway can support the correct data set does not make a merchant compliant automatically. Merchants should read the rules on this web site, which includes links to the card brand rules.

Card brand rules (Visa, MasterCard etc) are constantly changing and many payment gateways have not kept pace with been given a notice, then don’t call your existing provider. The rules were announced in 2016 and went into effect for most businesses (some were earlier) in October 2017. If your vendor let this happen to you, it’s time to get advice from another source. Here’s a list of payment gateways compatibility status.

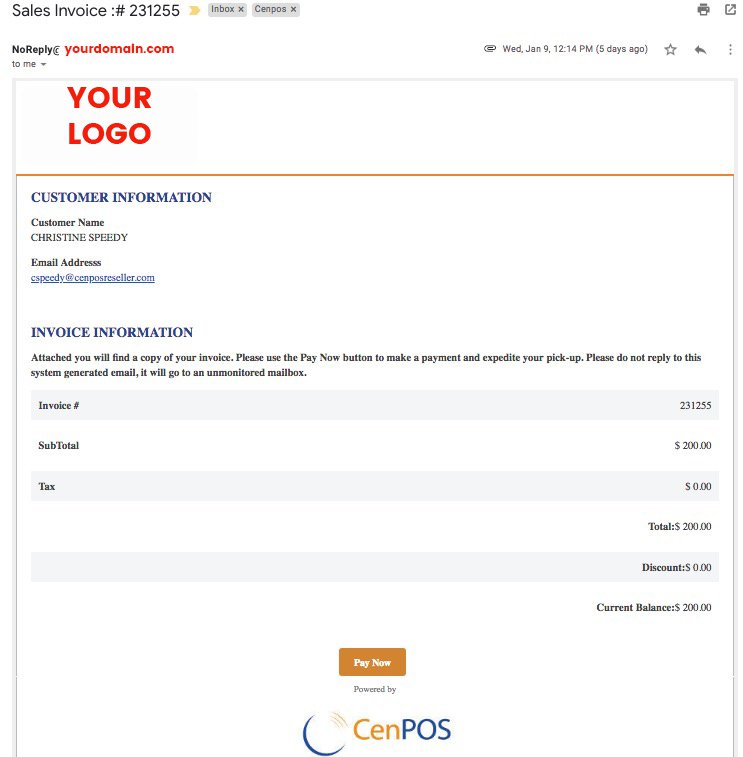

Call Christine Speedy, CenPOS Global Sales. 954-942-0483, 9-5 ET for all your stored credential payment gateway and virtual terminal needs. CenPOS is an integrated commerce technology platform driving innovative, omnichannel solutions tailored to meet a merchant’s market needs. Providing a single point of integration, the CenPOS platform combines payment, commerce and value-added functionality enabling merchants to transform their commerce experience, eliminate the need to manage complex integrations, reduce the burden of accepting payments and create deeper customer relationships.