Accepting credit cards for card not present customers can be risky, and merchants have long sought solutions to protect themselves from future disputes. The problem is most of those methods are PCI Compliance nightmares, often storing card data in the clear on paper credit card authorization forms. Enabling customers to self pay is one way to mitigate risk.

HOSTED PAY PAGE – ONLINE PAYMENTS

With a hosted pay page solution, customers are directed to a secure web page. The ‘host web server’ is the payment gateway, thus reducing merchant PCI Compliance burden. Gateways have different fraud tools for merchants, beyond the usual address and CVV security verification. Examples of hosted pay page solutions:

With a hosted pay page solution, customers are directed to a secure web page. The ‘host web server’ is the payment gateway, thus reducing merchant PCI Compliance burden. Gateways have different fraud tools for merchants, beyond the usual address and CVV security verification. Examples of hosted pay page solutions:

- Link to custom payment processor URL (First Data)

- Embedded payment object on merchant web page; the merchant should have an SSL certificate, even though the payment object itself is on a different server. This is usually achieved with an iframe. (CenPOS)

- Link to a custom payment gateway URL (CenPOS); this provides continuity when merchants change processors

ELECTRONIC BILL PRESENTMENT & PAYMENT (EBPP)

Customers are sent an electronic invoice, which they can pay remotely. Both merchants and customers have a portal to manage various functions. EBPP used to be costly, upwards of $100,000, but now, there’s solutions for all price ranges based on merchant needs. Examples of EBPP solutions:

Customers are sent an electronic invoice, which they can pay remotely. Both merchants and customers have a portal to manage various functions. EBPP used to be costly, upwards of $100,000, but now, there’s solutions for all price ranges based on merchant needs. Examples of EBPP solutions:

- Standalone– merchants login to a web based portal and generate an invoice which is delivered electronically to customers. (Paypal, CenPOS)

- Integrated, accounting software managed – customers receive electronic invoices with data originating from accounting, ERP, or other software, and the ERP managing the delivery of the invoice, reminders etc (Quickbooks & Intuit merchant services, ERP/CenPOS).

- Integrated, gateway managed – customers receive electronic invoices with data originating from accounting, ERP, or other software (Quickbooks & Intuit merchant services, Quickbooks & 3rd party gateway integration/ any merchant account), and the gateway managing the delivery of the invoice, collection reminders etc.

EBPP BENEFITS VS HOSTED PAY PAGE

- Pushes out to customer- less friction to complete the payment and or sale

- Reduce risk with additional evidence trail for dispute defense; records of invoice delivery and customer opted to pay strengthen defense; card brand rules include chargeback protection without a signature if bill to address matches the company address and the employee email address was used. (See Visa Merchant Rules for details)

- Automated reminders if they don’t pay (solutions vary widely how this works)

- Customer visibility to credit outstanding; ability to self-free up credit to buy more

- Reduced calls to accounts receivable for questions about what invoices are outstanding

HOSTED PAY PAGE & EBBP VENDOR SELECTION

There are wide differences in payment gateways, and the related solutions. The best solution varies depending on the business type.

Critical needs for business to business:

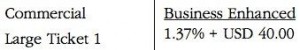

- Level III processing supported for all payment channels

- Collections automation

- Flexibility – the average merchant changes processors every three years; choose a gateway independent of the processor to avoid business disruptions

- 3 D Secure (Vbyv and MasterCard Secure) – card not present fraud is expected to rise dramatically with US EMV adoption

- Tokenization – empower customers to self store and manage payment methods

- Card Updater – if applicable for recurring service

CenPOS is a merchant centric, end to end payment engine that meets all omnichannel and critical business to business needs. For sales and integrations, contact Christine Speedy 954-942-0483.