What is bin management software, or bin spinning? How does bin management differ from interchange optimization with least cost routing? Shift4’s Universal Transaction Gateway® (UTG®), Element’s CardSense™, and CenPOS’s end to end payment engine have different approaches to helping merchants reduce credit card processing fees. Bin management requires a hosted, server-based payment gateway.

Identifying BIN numbers is a challenge due to multiple resources to obtain and maintain the data, which is in a constant state of flux. Card issuers refer to the leading six digits on the card as an “issuer identification number (IIN)”, or “bank identification number (BIN)”. All BIN’s have a sponsor bank. Interchange fees, the bulk of credit card processing fees are related to the BIN. The BIN number identifies the card brand (Visa, MasterCard etc), card issuing bank, type of card (debit or credit), category of card (business, purchasing, prepaid, etc), and country of origin, in addition to other data.

Is pin debit or signature debit cheaper? Cashiers were trained to ask “will that be credit or debit?” years ago when there was a significant cost differential between signature debit and pin debit. After the Durbin Amendment became law, about 70% of debit cards now carry the same cost of .05% and $.22 per transaction, but there’s still advantages to routing transactions:

- Pin debit has a 14 day dispute period vs 120 days for signature debit

- Dues and association fees are not applicable for pin debit

- For cards that don’t fall under the big bank rules of fixed .05%, fees vary depending on the transaction routing; there’s a threshold where it’s cheaper to process as signature vs pin debit.

All three gateways enable merchants to manage the threshold and can communicate with a terminal to prompt the customer in the optimal way for the merchant.

Shift4 vs CardSense vs CenPOS retail debit card bin management

Element PS CardSense BIN management service allows merchants to differentiate between credit, PIN-debit, prepaid, and FSA/HSA cards, and then business management software then allows the merchant to decide how to process the transaction: as a PIN debit, prepaid debit or a healthcare card; merchants are directed to the API for POS integration. To use CardSense, merchants must have an Element PS merchant account, and an API is available to integrate to their POS.

Shift4 identifies card type as debit or credit, then based on merchant defined threshold, prompts the customer the preferred way – signature or pin- to process the debit transaction. To use Shift4 for retail, merchants can use the virtual terminal with any merchant account, or integrate with a POS system.

CenPOS identifies card type as debit or credit, then based on merchant defined threshold, prompts the customer the preferred way – signature or pin- to process the debit transaction; additionally, using proprietary least cost routing technology, CenPOS dynamically routes the transaction to the lowest cost debit network (Star, Pulse, Internlink etc), if applicable. To use CenPOS for retail, merchants use the virtual terminal with any merchant account, or integrated with a POS system.

Shift4 vs CardSense vs CenPOS retail credit card bin management

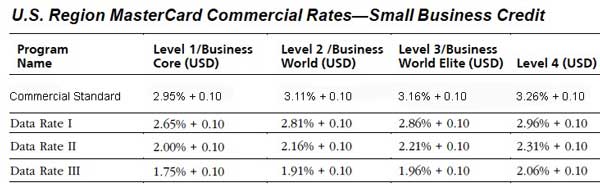

There’s no public information that Shift4 or CardSense offer additional bin management beyond debit. CenPOS retail bin management also supports all commercial cards, including corporate, purchasing, and business cards. CenPOS has uniquely certified their gateway for retail level III processing, significantly reducing interchange fees for eligible cards. For example, a $7,500 building supply sale could be reduced from 2.65% + $.10 to 1.20% + $40.00. Unlike pin debit, which prompts customers for action, level III prompts cashiers for action, and dependent upon merchant rules, cannot be bypassed.

Cash management optimization

CenPOS’s patented optimization of payment processing encompasses many elements to help merchants mitigate risk and increase profit margins. CenPOS products use merchant preferences and transaction profiles to manage the expense of payment interchange and provide a method for electronically delivering coupons. Using this technology, businesses can accept any form of payment via websites, store fronts, call centers, and mobile applications to improve customer engagement and simplify reconciliation. The intelligent system closely manages the full lifecycle of each transaction and utilizes advanced risk management and proprietary transaction routing to reduce the total cost of payment acceptance.

In summary, bin management is a host-based solution to help merchants reduce merchant fees and mitigate dispute or ‘chargeback’ risk. It’s a step above countertop terminal capabilities, but limited in impact since debit fees became regulated. CenPOS’s cash management optimization of payment processing is a powerful system empowering merchants to control profit margins across all sales channels.

Disclaimer: Shift4 and Element PS information is based upon publicly available information as of this date. The CenPOS information herein is not all inclusive.