Level 3 payment processing requires a level 3 gateway, but most merchants don’t realize how big an impact gateway selection has on merchant fees paid.

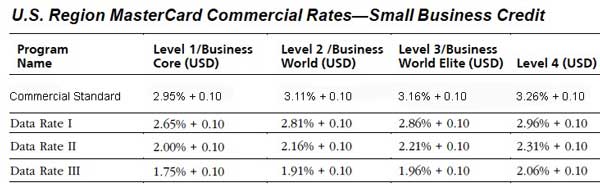

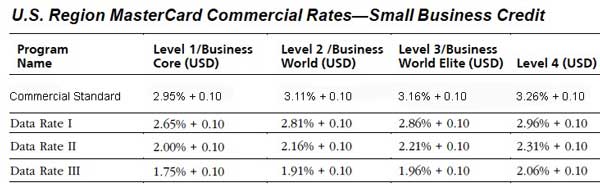

Merchants selling to other businesses or the government benefit from Level 3 processing and the savings this provides on commercial, purchasing and government transactions by processing level 3 Data. What gateway companies won’t tell you, is that not only do you need to send special data, but there are a bunch of rules to qualify for Data Rate III interchange rates as shown in the image below. Don’t follow the rules, and you’ll pay Data Rate I or Standard.

What are the rules? For starters, there are additional fields that must be submitted with the transaction. All the level 3 gateways support submitting the data, though they may do it in different ways. There are other rules such as the authorization and settlement amount must match. It’s unrealistic to expect any user to know all the rules for any transaction to qualify at the lowest interchange rate, so a payment gateway that automates that process is critical. This is where most payment gateways fail. They can submit data, but have no intelligence to help merchants comply with qualification rules.

What are the rules? For starters, there are additional fields that must be submitted with the transaction. All the level 3 gateways support submitting the data, though they may do it in different ways. There are other rules such as the authorization and settlement amount must match. It’s unrealistic to expect any user to know all the rules for any transaction to qualify at the lowest interchange rate, so a payment gateway that automates that process is critical. This is where most payment gateways fail. They can submit data, but have no intelligence to help merchants comply with qualification rules.

What gateway supports level 3 for retail, kiosk, mobile or any swiped transaction? CenPOS.

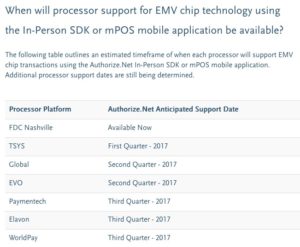

Gateways must certify level 3 to each acquirer, also known as payment processor, or credit card processor. The certifications can include for retail, retail EMV, MOTO (Mail Order Telephone Order), and ecommerce. Very few gateways certify level 3 for all sales channels. The only one I’m aware of that’s certified retail and retail EMV is CenPOS.

Gateways supporting level 3 for MOTO:

What level 3 gateway is compatible with First Data? CenPOS, First Data Global Gateway e4 – now called Payeezy. While CenPOS automates level III processing, First Data has multiple optional steps after the sale, leaving compliance up to the individual user; additionally, their method does not guarantee that all rules will be met to qualify for level III interchange rates. Authorize.net and Payflow Pro offer level III with certain API’s only.

What level 3 gateway is compatible with Vantiv or NPC? CenPOS

What level 3 gateway is compatible with Chase Paymentech? CenPOS, Paymentech Orbital, PayTrace. Paymentech and Paytrace have optional extra steps, leaving compliance up to the individual user; additionally, their methods do not guarantee that all rules will be met to qualify for level III interchange rates. Authorize.net and Payflow Pro offer level III with certain API’s only.

What level 3 gateway is compatible with Tsys? CenPOS, eProcessing Network, Authorize.net and Payflow Pro offer level III with certain API’s only

What level 3 gateway is compatible with Moneris? CenPOS

What about Revolution Payments, Vantage Card Services and other gateways not listed here? In most cases, the company is a reseller of a gateway listed above, not a gateway manufacturer. Network Merchants, LLC (NMI) distributes a white label solution that supports level 3 data, but there’s no public information about acquirer certification; BluePay and 3DSI also offer level 3, but it’s unclear what acquirers. Please add your suggestions in comments.

As of September 15, 2015, of the brands listed in this post, only CenPOS has both certified EMV terminals to accept chip cards with their gateway, and has also certified level 3 processing for all sales channels via any method, including API, virtual terminal, and online payments.