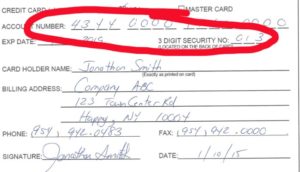

If you accept payments online, have you hardened security to protect from card testing? Card testing is a big criminal business. They’re sophisticated and use hardware and software that can send thousands of stolen credit card data in less than an hour to your payment portal or ecommerce shopping cart before you even know you’ve been hit.

Brute-force authorization attacks can be very expensive for merchants. For every attempted authorization, merchants pay a payment gateway fee, plus a fee to the merchant services processor (acquirer).

Example:

- $.30 per transaction gateway

- $.10 per transaction processor

- 20,000 cards tested @$.40= $8,000

There’s no getting back the $8,000. The gateway and processor passed the data you gave them. In the event orders are approved, there’s the additional cost of lost product shipped and the associated chargeback fee. Then there’s the cost of damaged brand reputation from cardholders who voice on social media, where it lives on forever, how their card was used unauthorized.

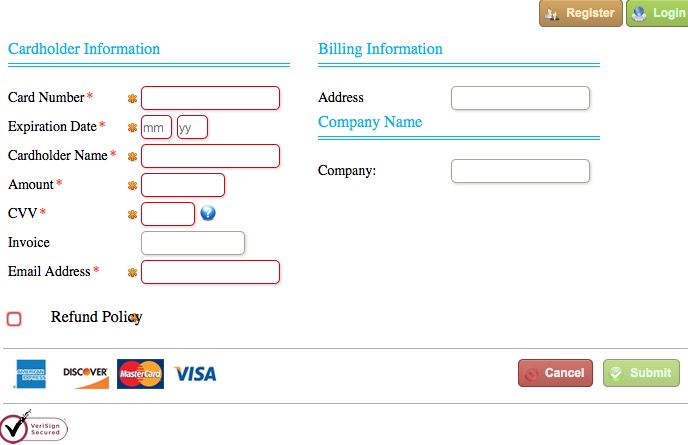

How can merchants protect online payments from card testers? Google reCAPTCHA is a free service that protects your website from spam and abuse. reCAPTCHA can prevent bots from submitting a transaction that you’ll pay for. For most shopping carts, it’s the payment gateway that must support reCAPTCHA. If the integration does not include reCAPTCHA or similar service, merchants might want to review if their gateway is compliant with current rules acceptance in general.

Protecting against both bots and fraudulent transactions is tricky.

Fifteen percent of all cardholders have had at least one transaction unnecessarily declined in the previous 12 months, according to a 2015 study by Javelin.

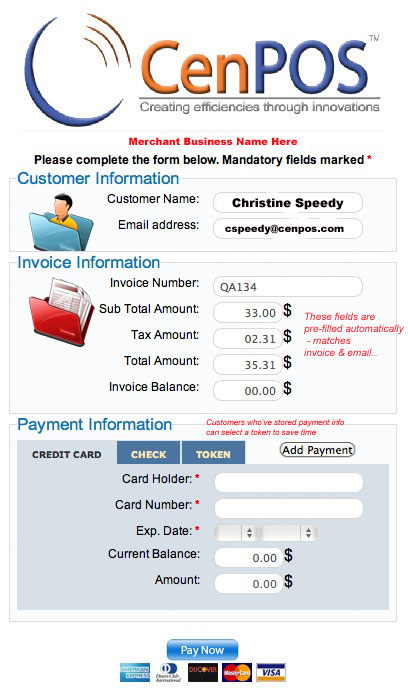

Unnecessary declines are also called False Positives. Cardholder authentication is a layer of security to protect against fraudulent purchasing, increasing approvals and reducing False Positives. 3-D Secure is a global XML protocol for Cardholder Authentication; The card brands each has their own name- Verified by Visa, Amex Safekey, MasterCard SecureCode. Benefits of 3-D Secure include automation, shifting liability to card issuers without manual review of orders, increased approvals, and sometimes reduced Visa and MasterCard interchange fees.

Which payment gateways support recaptcha and Cardholder authentication?

reCAPTCHA is easy to implement, just check with your payment gateway provider or web developer. 3-D Secure is quick, easy and requires a few steps:

- Confirm your payment gateway is 3-D Secure certified for your credit card processor (merchant services provider or acquirer). Ask which are certified: Verified by Visa, Amex Safekey, MasterCard SecureCode. Some have certifications, some don’t.

- If there’s an application such as a shopping cart or e-invoicing, confirm the payment gateway integration will support 3-D Secure.

- Contact your acquirer and ask them to register your merchant account for 3-D Secure. Some can, some can’t. It’s usually done in a day.

- Turn on 3-D Secure in the payment gateway.

FAQ

Is there a cost for reCAPTCHA? No, it’s free from Google. If your payment gateway supports reCAPTCHA, it may just need to be activated on your account, no programming needed. Contact your payment gateway support or check their FAQ to find out.

Is there a cost to register for 3-D Secure? That’s up to the individual company doing the registration. Costs start at $0.

Is there an ongoing cost to use 3-D Secure? Yes, and it’s up to the individual company offering the service. Costs typically range from $.075 to $.30 per attempted authorization.

If hit by a card tester, can I negotiate to reduce fees? It’s unlikely because services were delivered as per your agreements.

Christine Speedy, authorized CenPOS reseller, provides universal payment processing solutions, including reCAPTCHA and 3-D Secure cardholder authentication, to maximize merchant profits and mitigate risk across multiple sales channels. Contact Christine at 954-942-0483.