First Data Commercial Card Interchange Service to reduce fees for some merchants automatically.

The Commercial Card Interchange Service June 2017 merchant statement message to First Data Merchant Services, and Independent merchant service provider customers using the First Data credit card processing platform, is bound to raise questions. Essentially, the service automates sending additional data required to qualify some card types for lower rates. Skip to the bottom to see the impact if you already have the message details.

“Merchants using cloud-based payment processing solutions with interchange optimization, including level 3 processing, will continue to retain 100% of interchange savings”, says Christine Speedy, business to business payments expert.

FULL STATEMENT TEXT: Note- The live date and other language may vary, but the overall terms are the same for all merchants getting the message. “We are pleased to introduce the Commercial Card Interchange Service, designed to save you money by reducing the interchange cost for certain Commercial Card transactions. The card networks require that you include the sales tax amount with each transaction to get the best interchange for Commercial Card transactions. Your POS terminal should prompt for that information but often that prompt is bypassed so no tax information is sent causing a downgrade. With the CCIS service,when transactions do not include any tax information we will compute the sales tax based on the applicable rate at your location to allow you to obtain the best interchange. When we compute the sales tax on your behalf, we will retain 50% of the interchange savings. You will see this reflected on your monthly statements as Commercial Card Savings Adjustment. This adjustment is only applied when CCIS has improved your interchange qualification. You can save even more by entering the tax with each transaction at the point-of-sale, but if your employees do not do so, CCIS will help you qualify for Commercial Card interchange. If a transaction is fully or partially exempt, you should enter the tax amount (even if that amount is $0.00) as

CCIS applies your local tax rate to the full amount of transactions when the prompt is bypassed.

This service will begin on August 1, 2017. You may see savings beginning with your August statement. More detail about this new benefit can be found on the last page of this statement. Please call the customer service number on the statement if you do not want us to perform this service. Otherwise, continuing your merchant account with us or use of your merchant account after 30 days will represent your acceptance of these terms. If you have any questions, please contact customer service at the number on your statement.

����

Frequently Asked Questions- Commercial Card Interchange Service

Why am I eligible for a lower interchange on some Commercial Card Transactions? Some card networks require additional information beyond the total sales amount to qualify the Commercial Card transaction for a lower interchange rate. This information includes sales tax amount, which if provided reduces your interchange cost.

How does the service work? First Data will compute and submit the required sales tax to the Card networks on your behalf for applicable Commercial Card Transactions when not supplied in your submission. This additional data allows these transactions to qualify for a lower interchange rate that reduces your interchange cost.

Why is First Data offering this service? At First Data we are always working to bring you the broadest and most innovative range of payment options to grow your business and maximize your revenue. This is a new service that was developed to help merchant minimize interchange costs.

What is the cost of this service? There is no incremental cost for this service. Ignite payments shares in the savings it helps your company to achieve on qualifying transactions.

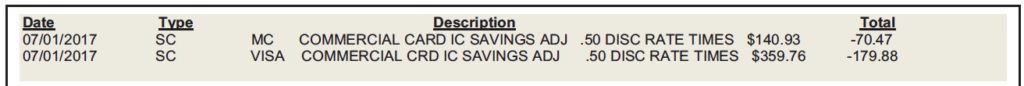

How can I see how much I have saved? The savings will be shown on each month’s statement. The adjustment to your account for this service wills appear in the Service Charge section of your processing statement. It will appear as “MC COMMERCIAL CARD IC SAVINGS ADJ” for applicable MasterCard Transactions and “VISA COMMERCIAL CRD IC SAVINGS ADJ” for applicable Visa transactions. The detail as in the example shown below will include: the total interchange savings; the portion of the interchange savings that will be retained by you; and the portion that we will retain.

Date Type Description Total

Date Type Description Total

05/01/2017 SC MC COMMERCIAL CARD IC SAVINGS ADJ .50 DISC RATE TIMES $140.93 -70.47

05/01/2017 SC VISA COMMERCIAL CARD IC SAVINGS ADJ .50 DISC RATE TIMES $359.76 -179.88

In the example above:

- Total savings of $140.93 was achieved on the eligible MasterCard Commercial Card transactions.

- You will recieve 50% of this savings, which is $70.47 and we will retain 50% (noted as the .50 DISC RATE).

Shown as -$70.47

Are there any setup fees that will be billed to my account to activate this service? No setup fees will be billed to your account upon activation of this service.

Will my business need to make any changes to utilize this service? No, First Data will perform this service completely during the interchange qualification and submission process to the card networks.

Will this service be performed on all Commercial Card transactions? This service will only be performed when a lower cost interchange qualification can be achieved on applicable Commercial Card transaction for which your business did not submit the required sales tax amount and did not identify as tax exempt.

Can my business request this interchange savings service be cancelled? Yes. This service can be cancelled upon request by the individual within your organization authorized to make accounts changes. If you prefer to opt out of this savings opportunity, please contact customer service at the number on your statement.

Who can I contact with additional questions? Please contact customer service at the number on your statements.” End statement message.

From Christine Speedy, business to business payments expert:

Is CCIS good or bad for merchants? Saving 50% automatically is good. Giving away 50% of the savings is bad, but might be the only option for some merchants due to business size, technology or other circumstance. CCIS does not ensure the lowest commercial card rates, only another possible level of savings. For B2B merchants especially, there are multiple ways to reduce fees with technology, including for card not present transactions.

How can I qualify for the lowest commercial card rates and keep 100% of the related savings?

- A cloud-based payment gateway is required. Desktop terminals are incapable of sending all the data required.

- Use a payment gateway that supports level 3 processing and will automate interchange optimization. More than just submitting sales tax, there are other rules that must be met to qualify for the best rates.

- Contact Christine Speedy for the best payment gateway analysis for your business needs, compatible with your existing merchant account and other software needs.

Cloud-based payment processing is critical to financial transparency. For example, credit card processing terminals batched out individually means management has to wait for reports. A cloud solution, including payment gateway, can provide real-time insights by dealer location or any other number of data points.

Cloud-based payment processing is critical to financial transparency. For example, credit card processing terminals batched out individually means management has to wait for reports. A cloud solution, including payment gateway, can provide real-time insights by dealer location or any other number of data points.