How can a hosted pay page or electronic bill presentment and payment (EBPP), also known as electronic invoice presentment and payment (EIPP) improve your customer experience? Cardholders are increasingly weary about giving out card data over the phone, or worse, via fax, which also has PCI Compliance implications. Reducing friction to collect payments, while putting cardholders in control of their data, is proven to increase sales and cashflow.

A hosted pay page enables customers to passively pay bills online via a secure web page. Payment types may include credit cards, Paypal, ACH (echeck), and other methods. The burden for entering all fields is on the customer. Many payment gateways offer this service free.

A hosted pay page empowers customers to make secure payments online.

With EBPP, the payment request is delivered to the customer via email or text. Instead of asking customers to find the pay page, the customer is given a link to pay a specific bill or invoice, or multiple invoices, and some of the data may be prefilled. Empowering customers to review and pay multiple invoices on demand by logging into a secure portal is also a significant benefit. With our recommended solution, repeat customers with stored payment methods can pay an invoice in 2 clicks, no login required. Customers prefer EBPP vs hosted pay page. Payment types may include credit cards, Paypal, ACH (echeck), wire, and other methods.

Body of email containing pre-filled payment info, and link to securely pay online.

Merchants can reduce risk of lost credit card disputes and resulting chargebacks with a multifaceted approach:

- Ecommerce merchant account is required

- Verify address & zip code

- Verify CVV / CID security code; if using token billing, prior validation is OK. You do not need to verify after the first transaction.

- 3-D Secure: Verified by Visa (Vbyv) and MasterCard SecureCode – cardholder authentication shifts fraud liability back to issuer. Not all issuers support and implementation varies by payment gateway and other factors. Check the rules to see how it fits in your fraud prevention program.

- How can a merchant enable customers to remotely pay an invoice, while maximizing security to prevent chargebacks from disputes? A critical step is managing the transaction representment to the issuer. It must be sent with the correct indicator and comply with all rules, including authorization validity

- Require all B2B customers to confirm copy of the emailed receipt via a company email address. This is overkill for for most, but effective as part of an exception plan.

- Optional custom procedures may be added based on risk tolerance.

In summary, either method of online payments increases security and enables customers to pay 24/7 to increase cash flow. EBPP or EIPP solutions have significant additional benefits and the cost to implement has dropped significantly, with many businesses experiencing an instant ROI.

UPDATE: To comply with Visa disclosure and consent rules, only use solutions with a checkbox to opt-in to terms.

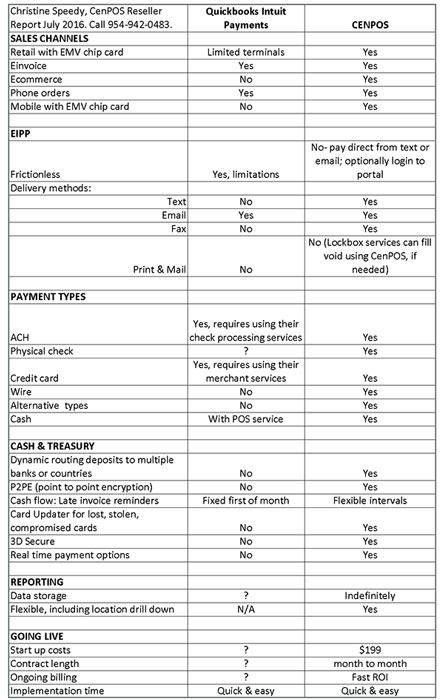

Christine Speedy, CenPOS global sales and integrated solutions reseller, 954-942-0483. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.

Credit card fraud is still rampant in the US, even after US EMV liability shift convinced many merchants to purchase terminals to support chip cards. Marine, auto, and other high value parts dealers have long had a problem mitigating fraud risk with local and international parts.

Credit card fraud is still rampant in the US, even after US EMV liability shift convinced many merchants to purchase terminals to support chip cards. Marine, auto, and other high value parts dealers have long had a problem mitigating fraud risk with local and international parts.