Looking for D635 F&O solution for clients to access online portal to view and pay invoices? One of the key solution differentiators is the integrated payment gateway for credit card processing. Easily overlooked, it’s most impactful on profits. Other than merchant discount, the payment gateway is the single largest influence on the cost of credit card acceptance and chargeback risk.

How can a payment gateway impact costs?

- Authorization management. There’s a slew of rules, which are continually changing, regarding what has to happen in order to qualify transactions for the lowest cost possible. Virtually no payment gateways support all of them. For example, authorize.net doesn’t support unscheduled credential on file (stored card on file). Reference https://community.developer.authorize.net/t5/Integration-and-Testing/Visa-Stored-Credentials/td-p/60149. The average cost differential for a Mastercard business card is 1% for a transaction with valid authorization vs invalid (but approved).

- Customer disputes and chargebacks. A merchant can only defend disputes if they have proper authorization in #1. Instead of wasting time defending disputes, merchants can prevent them with 3-DSecure 2.0, a global cardholder authentication solution. If the payment gateway supports it, “it wasn’t me, I didn’t authorize it” goes away; liability belongs to the issuer.

- Rate Qualification. Items 1 and 2 above both reduce the cost of card acceptance. So does supporting level 3 data. It amazes me how many calls I get from consultants and merchant services salesmen that just want to help their customers qualify business and purchasing cards for level 2 rates. Why wouldn’t you want all clients to qualify for level 3 rates, which are substantially lower for business to business transactions?

- Stored credential compliance. This is not just securely tokenizing cardholder data, but complying with a new set of rules established in 2017, which all merchants and acquirers are required to comply with. Payment gateways have no such requirement. They can choose to provide the services to clients or not. The trickiest is unscheduled credential on file, which is what most business to business companies need, unless they have a SaaS billing model. Towards the end of 2019, a few more gateways were offering this, but the list is very small.

Few payment gateways support all four items above.

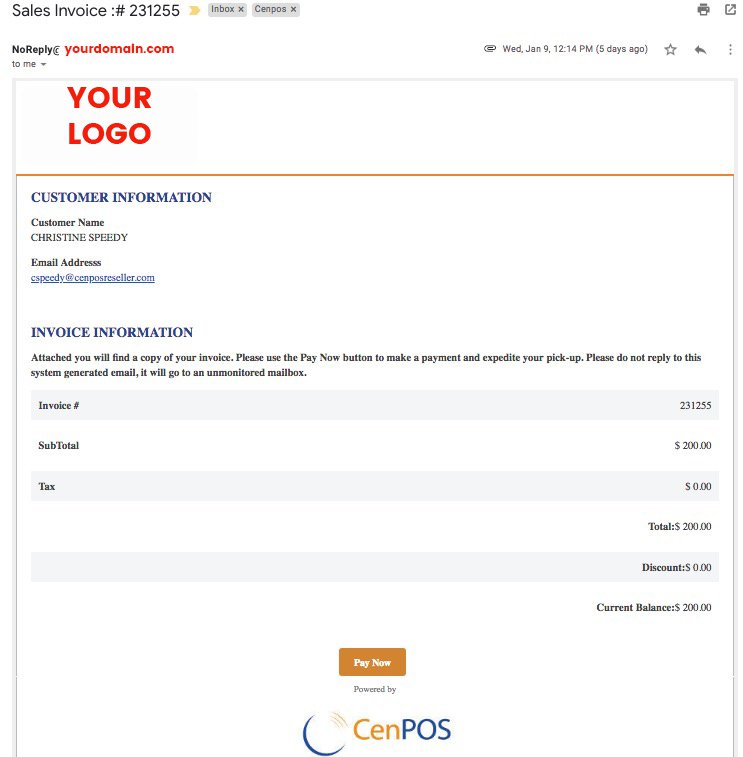

Call Christine Speedy for D365 F&O invoice portal with compliant payment gateway to maximize profits and improve your customer experience. 954-942-0483, 9-5 ET for all your recurring billing and stored credential payment gateway and virtual terminal needs.