Are automated recurring billing transactions declining due to expired credit cards? This article identifies methods to automate credit card expiration updating for installment, fixed recurring, and variable recurring token billing transactions.

All credit cards on file are managed at the payment gateway level for PCI Compliance. The ‘token’ is the alpha numeric character set that replaces sensitive card data. Businesses have access to the token, but not the sensitive cardholder data, after it’s stored. With token management, users can update the credit card expiration date manually. No other fields can be modified. If the CVV – CID security code or card number changes, a new token is created for the new card.

Per rules of card acceptance, the actual expiration date must be used. There have been recurring billing software solutions on the market that simply change the expiration date for recurring transactions with expired cards, for example by changing the date by one year. This enabled transactions to go through with an authorization in some cases because the expiration date was not validated by the issuer. However, for chargeback rights, the expiration date must be provided by the Cardholder and must be correct.

Credit Card Expiration Date Updater Methods

- Self credit card updating. An email is generated by the recurring billing platform and or payment gateway alerting the cardholder of an upcoming expiration. The cardholder then self-updates their payment method via a web portal. While effective at reducing phone calls for updating, it still requires action by the busy cardholder, thus, many still go unattended until the point that a transaction fails. This impacts profits with attempted transaction fees, the time to manually reach out to customers, and cancellations; We all know that sometimes a customer pays for a service they do not use effectively, but don’t bother to cancel. Once they have to update their card… the revenue stream can be lost.

- Automated credit card updating via the card brands. Merchants must register for the service with their merchant services provider, and must have a payment gateway that supports the updater service. Visa and MasterCard charge a one time fee for registration. There’s also a fee per card updated, which varies by merchant services provider; typically, the provider will mark up for profit.

Credit Card Expiration Date Updater Costs

One-time Visa Account Updater (VAU) Setup fee $250, MasterCard Automatic Billing Updater Setup fee $350 per merchant account. The fee per update varies. For example, we charge $.09 as of this writing and clients have been quoted $.30 by other companies.

Recurring Billing Compliance Alert

Significant changes are coming to recurring billing. After the first authorization, all subsequent recurring billing transactions are to include a unique reference to the initial authorization. This must be managed seamlessly in the background at the payment gateway level. Adding a new field to the transaction process is significant and the challenges are likely on par with the launch of US EMV. Expect problems in the next 12-24 months as gateways struggle to comply with these requirements.

Refer to Visa Public Rules, and search for “recurring”, including section 5.9.9 Prepayments, Repeated Payments, and Deferred Payments, for more details.

CenPOS and Credit Card Expiration Date Updater

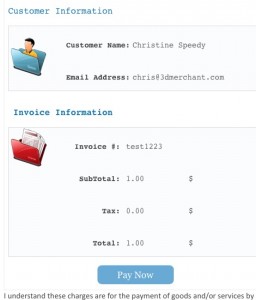

CenPOS, an enterprise payment gateway and merchant centric processing platform, supports the account updater services. As your CenPOS representative, I can activate the service on CenPOS for you, however, if your merchant services resides with a third party, you’ll still need to register through them. Before proceeding, contact Christine Speedy at 954-942-0483 for more information.