Mastercard and The Strawhecker Group released A B2B supplier’s guide

to optimizing commercial card payments. Selecting the right merchant acquirer and payment gateway, and optimizing interchange, can help reduce suppliers’ collection efforts and costs associated with commercial card payments. By Marie Elizabeth Aloisi and Peter Michaud. Christine Speedy, blog author, reviews the guide. In my opinion some elements, present an incomplete picture for merchants, especially the business suppliers accepting commercial payments that is the target of the paper.

The executive summary cites research that suppliers can reduce the cost of collecting funds from customers by 31% if they accept credit cards. I googled to find that commercial credit card research data, and though this is not the referenced Mastercard and Kaiser Associates, Commercial Card Acceptance Cost-Benefit Study, of November 2016, it has similar data:

- This study estimated card acceptance at the point-of-sale to be 37% less costly than using other payment collections methods – yielding savings of $12 on a $500 transaction

- Card acceptance provides a similar sized net benefit regardless of the funds transfer tool it replaces – e.g. check vs. ACH vs. wire

- The bulk of value from commercial card acceptance lies in its use as a pre-payment tool – providing revenue assurance against bad debts

I have a problem with the next line in the report, “That’s because getting paid by check—or even ACH or wire—involves many manual steps, onerous costs, and potential errors that are a burden to a supplier’s accounting, finance, and treasury functions.” Checks are still the most onerous even with a scanner, but with electronic bill presentment and payment, any other payment method can be automated for increased efficiency. Our cloud payment processing solutions, including integrated with ERP, automate all types of payment processing, including check/ACH, wire, credit card, and can update journals etc.

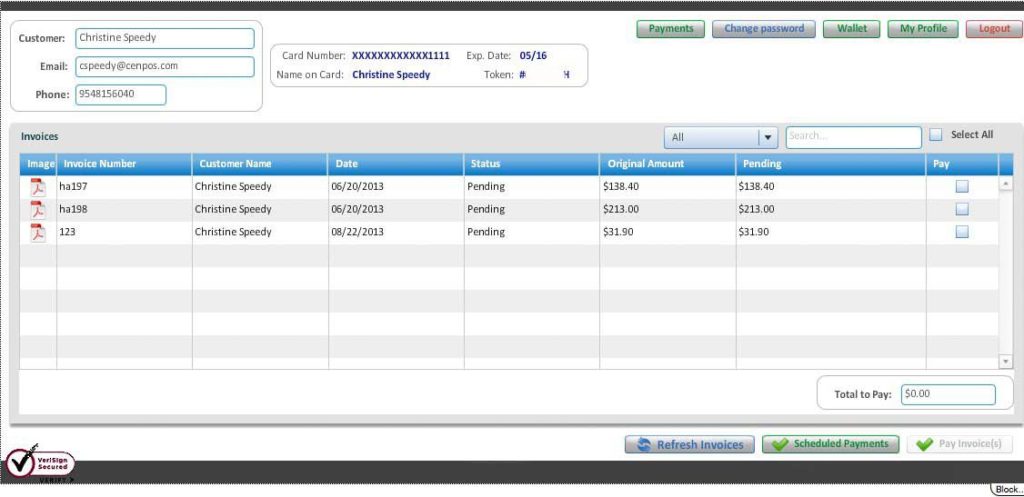

The paper goes on to explain why working with your acquirer is critical. While it mentions suppliers can benefit from advanced gateways, most acquirers offer a limited number of payment gateways to merchants. In fact, they may offer suppliers only one solution – they’re own- and it may not be the best for the supplier, it’s just the only one they offer. Independent payment gateways, like CenPOS that I offer, can provide significant advantages to maximize profits, efficiency and flexibility. For example, fulfilling the need to simplify wire transactions and match to invoices.

The three best practices cited to work with acquirers are to automate payments, optimize interchange and negotiate pricing.

The devil is in the details not cited. For example, “suppliers can only take advantage of lower interchange rates if the payment gateway is set up to pass Data Rate 3 information along with the transaction.” This is true. But the bigger problem is compliance with all the other rules required to qualify the transaction for Data Rate 3. For example, suppliers often do a preauthorization, which expires before settlement (but can still settle) or is not the same as the final settlement amount. These common transaction types will nullify qualifying for the best interchange rates, including MasterCard Data Rate 3. There are many more rules that make it tough to qualify and if the payment gateway does not automatically manage for suppliers, passing Data Rate 3 info doesn’t matter. The reality is most payment gateways do not have a solution to help suppliers comply.

Again, if the acquirer doesn’t have the best solution, should suppliers rely on their advice? A supplier client of mine went to their acquirer (top 5 in USA) and told them what I was offering. They would keep their acquirer but switch to my payment gateway; they’d use our electronic bill presentment and payment solution to eliminate paper credit card authorization forms and employees getting cardholder data over the phone. Customers would self-manage their payment methods, including storing & tokenizing if they chose to. Their acquirer did not want them to use any solution other than their own. They offered them a substantially worse solution- the silliest I’ve ever heard. The acquirer would give them a new merchant account with virtual terminal exclusively for one large client that they knew was using a commercial card. What about all the other clients? What about eliminating employee access to cardholder data and storing data on paper? Advising to use substandard solutions happens all the time.

In summary, Mastercard and The Strawhecker Group put out some great research data for suppliers. I’m a huge fan of the people at The Strawhecker Group and their work. Suppliers should look to cloud payment processing solution providers like myself at CenPOS for advice. Suppliers need the best payment gateway because without it, the rest doesn’t matter. Combining a robust payment gateway, business solutions, and the flexibility to change acquirers without business disruption can provide significant advantages.

All comments and statements herein are strictly my personal opinion and do not represent that of any company.

Christine Speedy, CenPOS sales 954-942-0483. CenPOS is a cloud business solutions provider with end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement.