Following several years of regulatory and technology credit card processing changes, 2015 has been another big year of changes. As we close out 2015, what are you advising clients to maximize profits? Every consultant to distributors, especially for building materials, including lumber and millwork, electrical, marble & stone, and plumbing supply, needs to update their merchant services knowledge. These businesses tend to have both a retail and a ‘to the trade’ component, making old solutions potentially outdated, risky, and costly.

Following several years of regulatory and technology credit card processing changes, 2015 has been another big year of changes. As we close out 2015, what are you advising clients to maximize profits? Every consultant to distributors, especially for building materials, including lumber and millwork, electrical, marble & stone, and plumbing supply, needs to update their merchant services knowledge. These businesses tend to have both a retail and a ‘to the trade’ component, making old solutions potentially outdated, risky, and costly.

- EMV liability shift October 2015, shifted liability for counterfeit card, and sometimes lost and stolen card, transaction losses from the issuer to the merchant, if the merchant does not support EMV chip card acceptance. Since businesses never saw this fraud, the financial risk is unknown, but guesses put it in the 1-2% of sales range. The first acquirer (Vantiv) announced penalties effective January 1 if a retail operation does not support EMV chip card transactions. These fees will grow throughout the payment chain in 2016, and be passed down to the merchant. If profit margins are important, EMV compliance is not optional. Between growth in credit card fraud losses and new penalties, distributors need to make the change ASAP.

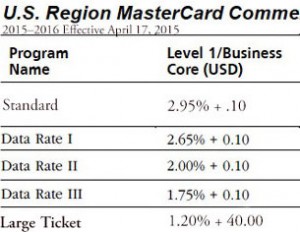

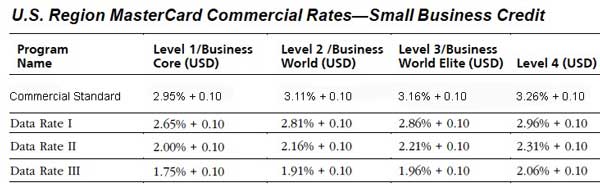

- EMV terminal selection. Retail Distributors fall into two categories: Those who use countertop terminals, and those who use anything else, including mag swipe reader or signature capture terminal. Only the latter are even capable of supporting level 3 data, critical for qualifying for level 3 interchange rates, which makes up more than 95% of credit card processing, or merchant, fees. Yet, the vast majority of recommended EMV solutions are incapable of level 3, and or there is no certification for it. While updating, add NFC for ApplePay and newer payment methods, and P2PE, which encrypts at the terminal head, further mitigating data breach risk. The best EMV terminal selection for distributors may reduce merchant fees an average of 32% and mitigate data breach risk. Conversely, the wrong choice will directly reduce profit margins.

- PCI Compliance. Internal and external data breaches are a serious growing problem (Lowes and Home Depot both admitted), and best practices are being shared among peers that are ‘risky’ at best. Top areas of concern are paper credit card authorization forms and electronically storing card data (without certified compliant tokenization such as a payment gateway). Both should be eliminated. Online pay pages and other technology solutions have negated the need for employees to ever have access to credit card data, not even for a minute. Has your own company eliminated them?

- Quickbooks. For operations that used Intuit Merchant Services because there was no other integrated choice, that’s no longer an issue. Third party integrations empower businesses to use any acquirer. Look for one that supports all payment methods needed (ACH, check, wire, credit card etc). If processing more than $500k annually, fees may drop up to 50%.

CHRISTINE’S RECOMMENDATIONS FOR CLIENT ADVICE TO DISTRIBUTORS:

- Implement EMV ASAP to avoid penalties and fraud losses.

- Only implement an EMV solution certified for level 3 processing to maximize profit margins.

- Get PCI 3.0 Compliant to mitigate risk of financial losses from a data breach- Replace all practices that include credit card access by any employee, even for a minute, with a technology solution.

- Replace Intuit Merchant Services to maximize profit margins.

Note: this advice is applicable to any business that has a customer base which includes some business to business and retail, even if retail is a small part of the overall payment types accepted.