Is it possible to have the payment link on statements as it is on invoices emailed to customer?

Yes, businesses using a desktop or self-hosted version of Quickbooks Enterprise and other versions can use the custom text field in the template set up to create a link. Customers click from the statement to a self-service portal to pay all invoices. This is not available with Intuit Merchant Services, but is supported with our third party module. The link from the invoice is to pay the specific invoice, no login required.

Are you tired of following up on late or past due receivables? Does it take weeks and months to get paid? Do your customers ‘lose invoices’? Do you want to qualify for low level III interchange rates for purchasing cards? Boost cash flow, efficiency and profits virtually overnight with the best alternative to Intuit merchant services for Quickbooks. Compatible with QuickBooks 2015 and 2016 Pro, Plus, Enterprise versions. (Not Quickbooks online.)

Adding a Pay Now Button Link To Quickbooks Statements

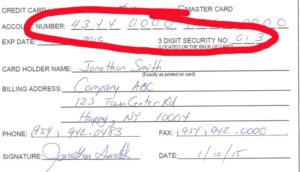

- Non-Intuit merchant account required to accept credit cards. Christine Speedy will help you with a wholesale account if you don’t already have one.

- Sign up for a CenPOS account with Christine Speedy.

- Install the supplied module.

Benefits

- Send invoices the way your customers want- text or email

- Automated reminder collections built-in

- Quickbooks updated automatically when customers pay

- ACH, wire, and Paypal, also supported

- 3-D Secure supported to shift card not present fraud liability to issuer

- For retail, full cashiering supported for 100% financial transparency.

- EMV chip and pin, chip and signature supported

- Smart rate selector reduces merchant fees

It’s quick and easy to get started with our Quickbooks credit card processing module so employees can get right to work without disruption.

Note: This article was accurate at the time written. Solutions are continually updated. Contact us for the latest facts.

Christine Speedy, CenPOS authorized reseller, 954-942-0483. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.