A preauthorization, or authorization hold, is a temporary hold on a customer’s credit card until final settlement. In this B2B transaction scenario, such as for distributors and manufacturers, the customer buys an item online, for example via Woocommerce or Shopify; the customer does not save their card on file or use a saved card on file, in which case different rules apply. Compliance with credit card processing rules improves authorization approvals, mitigates risk and reduces merchant fees.

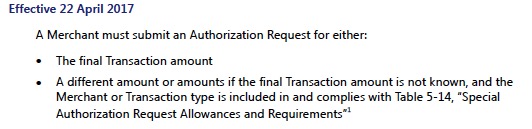

On the merchant side for ecommerce sale described: request for authorization goes out and the issuer responds with an approval code if all goes well. By also using 3-D Secure, the merchant shifts fraud liability to the issuer, reduces chargeback risk and can potentially qualify for reduced merchant fees. An additional authorization is not required if the final settlement amount is not more than 15% of the original authorization. Note, this is based upon scenario described! However, depending on the card type, the qualified interchange rate may downgrade to the worst rate possible due to authorization and settlement mismatch; The same applies if the final settlement on the original authorization is less.

Some, but not all payment gateways and API’s have solutions to help merchants resolve the mismatch problem.

How can merchant maximize profits on this type of transaction? Here are some requirements:

- Settlement date must be within 2 days of the transaction date.

- Settlement date must be within 7 days of initial authorization for purchasing cards (non-gov)

- Obtain and pass 1 valid electronic authorization. Authorization and

settlement MCC must match. One authorization reversal is allowed. - Transaction date must equal shipping date and that date is no more than 7 days after authorization.

- Transaction must include order number and either customer service phone number, URL or email.

- Must have secured E-Commerce indicator of “5” or “6”. The POS Condition Code must be “59”. Must perform Cardholder Authentication Verification Value (CAVV) and AVS4 (zip code, except goverment cards).

- Must Pass Level II and Level III Data.

Failure to meet all requirements can increase merchant fees more to an additional 1% or more of the transaction amount.

References:

Visa Product and Services Rules, section 5.8.3.1

Christine Speedy, Founder 3D Merchant Services, is a credit card processing expert with specialized expertise in card not present and omnichannel technology. Christine is an authorized reseller for Elavon and CenPOS products and services, in addition to other solutions. Call Christine for payment gateway, cloud technology, merchant services and check processing needs.