Which is the best payment gateway for Magento developers B2B clients?

The answer lies in Magento top user concerns, which are security & PCI Compliance, cost, customer experience and flexibility with other systems including ERP and accounting.

Security and PCI Compliance: PCI should be a non-issue as any payment gateway being suggested for a B2B company should be level 1 PCI Compliant. However, developers can help merchants reduce PCI Compliance burden by partnering with a B2B payment gateway specialist who can recommend payment gateway solutions compatible with all business needs, not just Magento. For example, does the business also send invoices from an ERP? Do salesmen or credit managers get credit card numbers via fax or phone? Magento developers are not experts in payments and cannot be expected to ask the right questions to help solve unrelated compliance problems.

Internal and external fraud protection are critical. At a minimum, the payment gateway must support 3-D Secure, including Verified by Visa and MasterCard SecureCode to shift liability for certain types of fraud from merchant to card issuer.

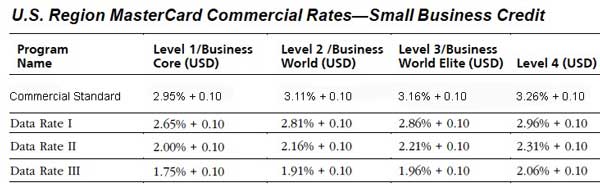

Payment Gateway Cost: The worst mistake is recommending or selection a payment gateway based on per transaction cost. The payment gateway plays a critical role in interchange rate qualification, which comprises over 95% of merchant fees. Gateway capabilities, and lack thereof, can literally double the cost of credit card acceptance for B2B. The most important base criteria is it must support Level 3 processing. There are many nuances to qualifying transactions correctly, that most credit card processor salesmen don’t understand, so there’s little expectation a developer would have the global financial expertise to recommend the best choice.

Treasury Management: Where are your customers? Where are your offices? What currency do you want to collect and bill in? Authorize.net has virtually nothing to help manage cross-border sales. CenPOS has a multitude of treasury solutions that can be customized.

For example, a company bills everything from the US, but also has operations in Canada and the European Union. Authorize.net will process every transaction in USD. The company pays cross-border fees on foreign issued cards, which now exceed 1% in some cases, and then pays again to repatriate revenue back to the EU or Canadian operations. CenPOS automatically identifies and processes the transaction in the local issuer currency, avoiding costly cross-border fees and more expensive US interchange rates, and deposits in the regional account. It does this seamlessly with no special developer programming.

Customer Experience: Will the gateway enhance or detract? In most cases, there’s very little difference in the checkout experience, but for B2B, there’s a bigger picture. What if the customer buys via multiple channels? Sharing tokens across multiple channels, including for emailed invoices may be important. A holistic look at all sales channels and payment methods is essential, but it’s not a good use of a developers time, thus deferring to payment expert will yield a better ROI for developer and better result for the business.

Flexibility: Payment acceptance types, global availability, omnichannel integrations, flexibility and scalability are all factors in choosing not only the best B2B payment gateway for Magento, but also for the entire organization. For example, if there’s also a retail component, US businesses also need an EMV solution that supports level 3 processing for retail. If the distributor is global, how many countries is the gateway available in?

Back Office Efficiency: If you’ve ever done research in Authorize.net reports, and then in CenPOS, you’ll appreciate the massive difference between download and search vs dynamic drill down within CenPOS online reports. CenPOS reports were designed with input from today’s businesses, not those of over a decade ago. Too many differences to mention here.

There’s a plethora of misinformation across multiple industries ranging from consultants to developers. Defaulting to Authorize.net or Payflow Pro because they’re two of the oldest payment gateways, is an injustice to the end user. Payment gateway selection plays a crucial role in business profits, security and efficiency. By partnering with a payments expert, clients are provided the best solution, and Magento developers can grow revenues with specialty implementation and add-on services the expert recommends.

“I have some knowledge of Magento, including as a developer in it’s early years, but I’m not a Magento expert,” says Christine Speedy, owner of 3D Merchant Services and B2B payment gateway expert. “Likewise, there are great B2B Magento developers, that are not payment gateway experts. By partnering, we can offer businesses more appropriate solutions to maximize profits and security, while also mutually benefiting. “