Ready to improve PCI Compliance with token billing? Step by step instructions for CenPOS card not present token billing including creating, modifying, and using tokens follows.

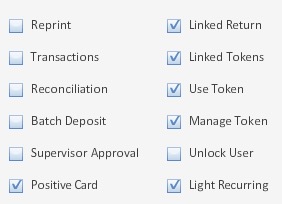

- In the virtual terminal admin, Create a new Role* or Modify an existing role to include token billing permissions, only for what the user is allowed to do. For example, if you employees are allowed to create tokens, but not conduct sales, check the Manage Token and Positive Card only.

- Are email receipts available now? If no, send an email request to support via link on the virtual terminal login page. In the subject put: “your CenPOS MID” email receipt request. In the body, include all your contact info, the MID, and what email address you want receipts to come from.

- Prepare training worksheet for distribution

- Distribute Self-paced training checklist (10 minutes to complete) to all users

- Get documentation of all training- who, what, when. It may be useful as part of an overall PCI Compliance (Payment Card Industry Data Security Standards) plan to comply with section 12, Maintain an Information Security Policy.

- Assign users to the new roles with return of documentation

- If there’s any legacy cardholder data on file, plan it’s secure destruction

References: Token Billing Training Videos

- Manage Token – https://www.youtube.com/watch?v=lHyKaEM9FBc

- Use Token – https://www.youtube.com/watch?v=blAnvG2Vd7A

- Use Token with level 3 commercial card https://www.youtube.com/watch?v=s6eUEeWcm5k

- Modify Tokens – https://www.youtube.com/watch?v=7PxCDgP5noc

- Positive Card Verification – https://www.youtube.com/watch?v=-04uyTvLdBs

*See CenPOS Virtual Terminal Manual for details on using Role Templates.

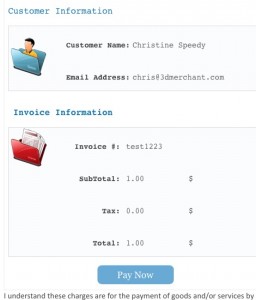

A sample document, created by Christine Speedy, for training and documentation is available upon request.