Refer a business for a new merchant account and get paid $150 per new merchant account. If the business has multiple locations, you get the referral money for each location, no limits! Valid for USA merchants only and account must be approved by 12/31/2020.

What happens if the merchant is not approved by the end of 2020? The promotion is only valid in 2020, however, it will be reviewed on a case by case basis. If you refer a sizeable account, then you’ll likely get compensated, but depending on the number of locations, there may be a delay.

What happens if the merchant doesn’t sign by the end of 2020, but does sign in January or later? The promotion is only valid in 2020, however, it will be reviewed on a case by case basis. If you refer a sizeable account, then you’ll likely get compensated, but depending on the number of locations, there may be a delay.

Do you pay the referral to a person or to a company? That’s up to whomever does the referral.

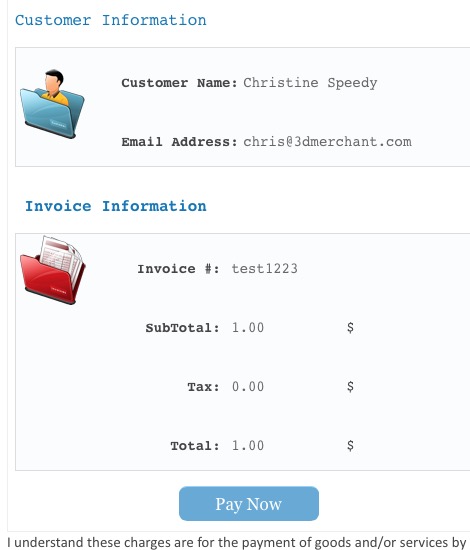

Christine Speedy, Founder 3D Merchant Services, QIR certified, is a credit card processing expert with specialized expertise in card not present and B2B payment processing technology. Less than 1% of all merchant services sales representatives are QIR certified by the PCI Council. Christine is an authorized independent sales agent for a variety of merchant services and payment techology solutions.

If merchants follow all the above rules, they will get paid faster, increase customer satisfaction, and incremental sales and profits.

If merchants follow all the above rules, they will get paid faster, increase customer satisfaction, and incremental sales and profits.