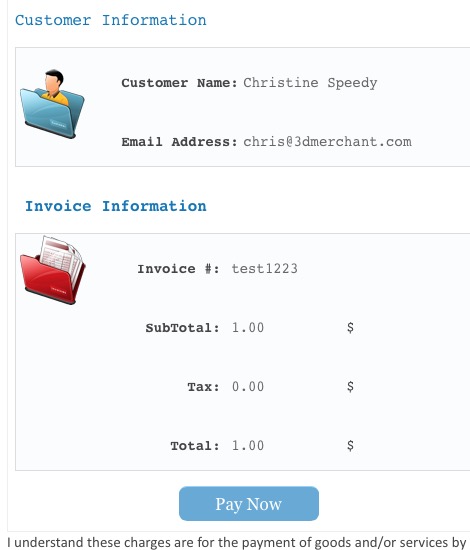

Express checkout enables customers to pay for invoices, bills, products and services from an email or text message. During the Covid crisis, many businesses have searched for solutions, but not nearly enough have implemented solutions. As a customer, I’m still stuck trying to reach people in different time zones that are not in the office, or solutions that are frequently down or not compliant with card acceptance rules, which puts my card security at risk.

Checklist for B2B card not present express checkout:

- Must offer the ability to store a card (which will be managed by the third party provider).

- Storing cards must comply with current rules for storing and managing stored cards, including the ability for the customer to manage on demand which cards are on file, delete on demand, etc. See Visa stored credential mandate.

- The process to store a card should include a checkbox to opt-in to store the card.

- Merchant should secure the transaction with 3-D Secure to ensure lowest fees and chargeback protection.

- If not using an integrated solution, it should include the ability to attach invoice on demand to send with payment request.

- Solution must support level 3 processing, again to reduce merchant fees and maximize profits.

- Optional: partial payments. Some merchants may want to allow partial payment so at least collecting some money while other portion is in dispute or for other reasons.

- If omnichannel, the ability to use the same gateway for all services simplifies security management and accounting.

- Solution should be compatible with any merchant account so if you make a change, it does not disrupt consumer or merchant.

If merchants follow all the above rules, they will get paid faster, increase customer satisfaction, and incremental sales and profits.

If merchants follow all the above rules, they will get paid faster, increase customer satisfaction, and incremental sales and profits.

Both EIPP and EBPP refer to electronic bill presentment and payment and the term can be used interchangeably. E-invoicing and Ebilling started out as a way to electronically deliver invoices. But now merchants can simply send a payment request, send an invoice, or send an account sign up for the customer to self-input their card on file so the merchant never, ever inputs cardholder data.

Don’t wait. Your customers will walk away when it’s easier to do business with someone else, especially for product lines available from multiple distributors.

Christine Speedy, Founder 3D Merchant Services, is a credit card processing expert with specialized expertise in card not present and B2B payment processing technology. Christine is an authorized reseller for Elavon and CenPOS products and services, in addition to other solutions and is QIR certified by the PCI Council. Call Christine for all merchant services related needs.