Christine Speedy will be on the BocaJS experts panel in Boca Raton, Florida. Christine’s background in ecommerce stems from when the internet first started. With skilled coding labor shortages, Christine learned html to help get stuff done for clients which included the Miami Dolphins, Blockbuster, the Florida Marlins and many others. While leaving serious work up to the coders and integrators today, her payment checkout insights are unparalleled for PCI Compliance and card network rules compliance. Get to know the industries best experts on everything from Development, Design, IT, DevOps, Recruiting, and Learning in Boca Raton, Florida.

980 North Federal Highway · Boca Raton, FL

About The BocaJS group

The BocaJS group is here to represent the best that South Florida can bring to the world’s best Language (Javascript). And any else web related as well! In addition to vanilla java script, we’ll be looking at frameworks such as Node, AngularJS (1, 1.5 AND 2,4,5,6,…. 7 beta? ), Ember.js, jQuery, ReactJS and Ionic. Founded in September 2014 by Adam & Hector, and Run currently by Damian Montero and Jermbo Lawson this group continues to grow and thrive. Website: BocaJS.org (https://bocajs.org/)

About Christine Speedy

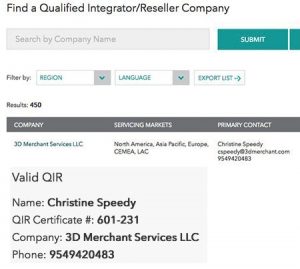

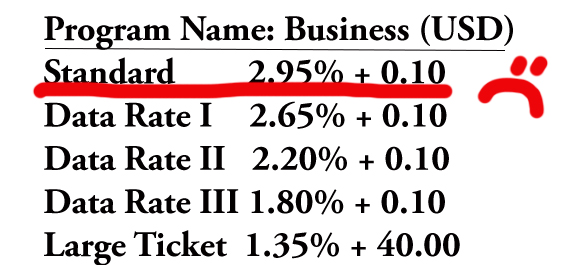

Christine Speedy is a Qualified Integrator and Reseller payments professional, certified by the Payment Card Industry Security Standards Council, and authorized CenPOS Reseller. Christine is a subject matter expert on PCI compliance and card network rules compliance, offering secure cloud payment technology to businesses, transforming the commerce and customer experience. South Florida Technology Alliance member.