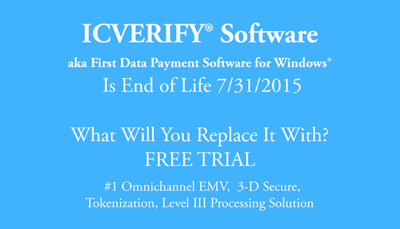

First Data announced today the end of life for ICVerify® Software, also known as First Data Payment Software for Windows®. Following a similar announcement by Verifone for PCCharge in May 2015, It was inevitable that ICVERIFY Software, another PC based payment software solution would also be deemed obsolete. What will software companies and merchant users replace it with?

First Data announced today the end of life for ICVerify® Software, also known as First Data Payment Software for Windows®. Following a similar announcement by Verifone for PCCharge in May 2015, It was inevitable that ICVERIFY Software, another PC based payment software solution would also be deemed obsolete. What will software companies and merchant users replace it with?

What does ICVERIFY Software end of life mean?

Product development has ended. First Data has a timeline to stop selling and stop supporting ICVERIFY. The product owner does not have to immediately change, but should review the timeline and consequences for future business decisions.

ICVERIFY KEY DATES:

- June 17, 2015 End of Development Date: Effective immediately, there will be no new development for the ICVerify product. This includes development work requested as a result of a support issue.

- July 31, 2015 Final Order/Shipment Date: No new orders or licenses. No new MID/TIDs or adding users to existing licenses.

- June 30, 2016, End of Support Date: First Data support discontinued. Up until that date, both level 1 and level 2 telephone support for existing users.

First Data will honor valid ICVerify support contracts for customers that have purchased annual support, prior to June 17, 2015, through the end of their annual term. Effective immediately support contracts will not be renewed. This includes contracts for Level 2 integration support for First Data clients as well as Level 1 support agreements for non-First Data clients. Level 1 support for First Data clients will remain free until June 30, 2016.

“This is an ideal time to examine long term omnichannel payment needs to avoid transitioning to other outdated technology,” according to Christine Speedy, a cloud payments expert. “At their core, all payment gateways enable merchants to process web based transactions securely with cloud solutions. Beyond that, there are many differences, and even bleeding edge solutions could lead to further disruption, if the new technology disappears when ideas don’t catch on or venture capital dries up.”

What solutions can replace IC Verify? The days of Windows based payment solutions have been replaced with cloud or internet based payment gateways. What’s the difference between ICVerify and a Payment Gateway?

- The most obvious is there’s no software to install. Users process payments via a virtual terminal (login in to a secure web page), or via payment gateway integration. This alleviates many problems related to maintaining current desktop based software, but not all of them, as merchants are still expected to maintain firewalls, update Windows, web browsers etc. for PCI Compliance.

- Transaction fees are standard. However, these fees can be offset by efficiency gains, reduced PCI Compliance burden, and even reduced merchant fees through better interchange rate qualification.

- More features, user accessibility, and reporting capabilities.

TIPS FOR NEW PAYMENT GATEWAY VENDOR SELECTION:

Is 3-D Secure (Verified by Visa and MasterCard Secure) for card not present transactions supported?

Are there any EMV certifications? If not, what is the roap map time frame? (note- EMV certified is not the same as EMV ready or capable)

Is the gateway processor neutral to provide maximum financial flexibility? (Critical for integrations.)

If business to business, for which sales channels does the gateway support level III processing? (mobile, retail, EBPP, kiosk, online payments, ecommerce, other) Can the user bypass submitting level III data on eligible transactions?

Is ACH supported? (If no, this is a red flag as lagging in innovation.)

What type of audit trail is available for PCI 3.0? How long is the data accessible?

ICVERIFY REPLACEMENT PAYMENT GATEWAY OPTIONS

I believe flexibility to choose your own credit card processor (acquirer) and change processors without disrupting business operations is critical for payment gateway vendor selection. For example, Payeezy is First Data’s gateway and it only works with First Data. The list below is payment gateways compatible with most existing merchant accounts, and capable of level 3 processing, critical to qualify for lower interchange fees for business to business; merchants can change acquirers and simply point gateway to the new merchant account.

-

CenPOS

CenPOS is a robust, global payment gateway. EMV, 3-D Secure, ACH, credit card, level 3 processing, Electronic Bill Presentment & Payment (EBPP), audit trail for every touch to system by user, indefinite record retention, dynamic search online or download; robust custom reports, alerts and distribution. CenPOS does not publish rates online; contact us for a quick quote. For business to business, CenPOS far exceeds any competitors for ROI. Call 954-942-0483 for a quick CenPOS quote.

-

Authorize.net – no EMV chip card options as of 4/11/2016

Authorize.net is one of the oldest payment gateways. ACH, credit card, 24 month record retention and search; download reports only. 3-D Secure and level 3 processing typically not available,might be available for card not present depending on integration, “We currently expect the mPOS app and VPOS to support chip payments in the second quarter of 2016.” Link to authorize.net EMV schedule. Update July 2016- looks like they missed the first support date. Call 954-942-0483 for an authorize.net quote.

-

PayTrace- no EMV chip card options as of 4/11/2016

ACH, credit card, 24 month record retention and search; download reports only. Level 3 processing might be available for card not present depending on integration. “PayTrace anticipated launching its virtual terminal EMV solution toward the end of 2015. Although significant advancements in the product development have been executed, we need more time to complete the certification process. As a result, our timeline has moved into 2016.” Link to Paytrace EMV schedule. Update July 2016- first support date has moved to second half of 2016.

-

eProcessing Network- no EMV chip card options as of 4/11/2016

ACH, credit card, 24 month record retention and search; download reports only.Level 3 processing might be available for card not present depending on integration.

Do you need a new payment gateway to replace your ICVERIFY account? Payment gateway selection can significantly impact EBITDA, PCI Compliance, and efficiencies. Contact Christine Speedy at 954-942-0483 for standalone, integrated solutions and any new payment gateway accounts.