Be wary of sites that list the top 10 best solutions to accept payments online, 10 best payment gateways etc. These sites solicit payment gateway vendors to get on the list. Those who pay the fee get on the list, regardless of whether they’re the best of anything. The vendor checklist below will help businesses that process more than $500,000 annually across all sales channels.

Be wary of sites that list the top 10 best solutions to accept payments online, 10 best payment gateways etc. These sites solicit payment gateway vendors to get on the list. Those who pay the fee get on the list, regardless of whether they’re the best of anything. The vendor checklist below will help businesses that process more than $500,000 annually across all sales channels.

First make a list of needs, then compare to vendor options listed. Because a payment gateway is required for online payments, all questions are specifically for the gateway, regardless of whether the vendor also offers merchant services or check processing.

Circle immediate needs and write F next to potential future needs.

Where does your business want to accept payments now and in the future?

Make a list of all sales channels. The merchant industry impacts complexity of solutions needed. For example, a distributor might payments online, at a distribution outlet, via ecommerce, and ebilling; a law firm might accept payments online, but not in person. A non-profit may need to accept payments online and at events.

- online payments

- retail swipe

- mobile swipe

- ecommerce

- einvoice

- kiosk

Do you need level III processing?

- Yes

- No

Qualified merchants with at least a portion of business to business (B2B) or business to government (B2G) customers should require level III processing across all sales channels where payments are accepted. Manufacturers, distributors, and services that are generally business to business usually qualify.

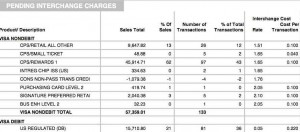

How will the solution help automate interchange management, the bulk of processing fees?

- Yes, has ‘automated interchange management system’

- No, does not have ‘automated interchange management system’

If a company offers it, they’ll advertise it because it’s a competitive edge. Probably fewer than 10% offer it. There are many complexities and comparing may be a challenge. For example, if the authorization and settlement amount differ, the transaction will result in additional fees, Unless the solution resolves this difference by obtaining a new authorization. This item can be difficult for merchants to compare from solution to solution, so ask open ended questions.

Do you need online payments for credit cards, ACH or both?

- credit cards

- ACH

- both credit cards and ACH

I once had a software company tell me their vendor had promised for years to provide online ACH. They’re still waiting. Shortlist only providers that process what you need now. Custom online payment forms are easy; Certifications for check or credit card processing is not as simple.

How does merchant know when a payment is received?

- Integrate to accounting or other software (Quickbooks, ERP etc)

- Online report

- Other

How does merchant differentiate between online payments and payments key entered by employee or other source?

- Each payment identifies user that made it

- Multiple accounts or deposits

- None

- Other

Can customers store credit card data?

- Yes

- No

Can customers store ACH data?

- Yes

- No

- N/A

Are expiring cards managed proactively? Are customers notified in advance to self update?

- Yes, proactive

- No, no advance notice and ability to self update

Can tokens, which replace sensitive card data, be used across all sales channels and or company divisions needed?

- Yes

- No

- N/A

Does the transaction occur on merchant server does user click to hosted payment page?

- Hosted pay page

- Merchant web page with iframe

- Both options

Does it support multi currency processing?

- Yes

- No

- N/A

What are customer service communication methods? circle all that apply

- Phone 24/7 or limited hours

- email 24/7 or limited hours

- chat 24/7 or limited hours

- Designated relationship manager

Other questions

- What reports are available?

- How long are they available?

- Can reports be exported?

- How can reports be shared?

- How will solution help reduce PCI Compliance burden across all sales channels?

Online Payment Solutions:

- CenPOS, a processor neutral omnichannel super payment gateway, available globally including United States, Canada, United Kingdom, Europe, Australia, Latin America, South Africa, Asia Pacific, and more. Supports all merchant sales channels, multi currency processing, and level III processing all sales channels. Industry specialties: Automotive, manufacturer, distributor, private duty healthcare, non-profit, education. Free online pay page html5 available.

-

First Data Global Gateway e4, for First Data Merchants only. Supports all merchant sales channels, level III processing in some sales channels. Industry specialties: Automotive, manufacturer, distributor, private duty healthcare, non-profit, education. Online pay page html available.

- Authorize.net, a Cybersource/ Visa company, compatible with most processors. The gateway is available in United States, Canada, United Kingdom, Europe, Australia. Online pay page html available.

- PayPal Pro, requires Paypal payment processing. This is included because of the simplicity and longevity for online payments, however, Paypal differs significantly from all others; payments must be manually transferred to the bank, increasing time to deposit, and fees are netted from every transaction, making reconciliation more challenging.

This list does not include solutions from companies that are registered ISO of Wells Fargo Bank, N.A., because those are First Data resellers. (The text is found on the bottom of many web sites.)