Intuit merchant services has pros and cons, like all credit card processing solutions. This review will help you make the best choice for a merchant account.

Intuit Merchant Services vs Regular Merchant Account

There are two main differences:

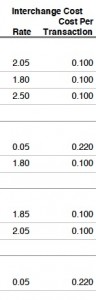

- Price structure. Intuit has a flat percentage and per transaction for key entered and one for swiped. For example, the Intuit keyed rate is 3.40% + $.25 + $.10 address verification service or AVS. A regular merchant account includes interchange and a bunch of other fees. Even though those ‘other’ fees could add up to .10% or more, the overall effective rate (fees divided by costs) is normally always lower than the Intuit effective rate for merchants on ‘pass through’ pricing like offered here. As shown in the image below, interchange starts at .05%.

- Cash flow. Intuit nets fees from every sale. For example, using the keyed rate of 3.40% + $.25 + $.10 avs, for a $100 key entered transaction, the Intuit merchant receives a $96.25 deposit the next day. It’s possible the amount varies due to international fee etc. With a regular merchant account, the merchant receives $100 deposit within 1- 2 business days, and at the end of the month, pays the total months fees via ACH.

Extra Intuit fees are found in INTUIT QUICKBOOKS PAYMENTS PRICING SCHEDULE. The only fee that stands out is AVS, or address verification service, at $.10 each; it’s at least 100% more than regular merchant accounts, and since merchants should supply AVS for all card not present transactions, add it in as a hard cost per transaction when comparing options. The rest of the fees are in line with costs anywhere.

How do the differences impact merchants?

A company with $1,000,000 in credit card sales might have an effective rate between 1.3% and 2.75%, depending on business type etc. A 1% drop in effective rate equals $1000 in savings for this example. More importantly, merchants can preserve cash flow by paying fees after the month is over, and keep reconciliation clean with fees applied to COGS once per month, vs every transaction.

For very small businesses, it almost doesn’t make any difference who the merchant uses for processing. The effective rate is 3.75% in the example above. If you run the numbers with fees from Costco and others, it will end up being relatively the same, and most importantly, a small difference, isn’t really going to make a bid difference in the overall fees paid; a .1% difference on $100,000 is $100 per year. I think a small business should focus more on growing revenues than fretting over fees.

Managing credit card payments within Quickbooks vs regular merchant account

Options:

- Intuit merchant services applies payments to invoices and sales receipts. Quickbooks mobile GoPayment. The last user report received was that QB created a new customer for any unrecognized cardholder and this was problematic, because the merchant already has the customer registered under a company name. This problem is common with both Quickbooks and some 3rd party solutions.

- Merchants use a regular merchant account and process transactions, such as a virtual terminal, ecommerce store, or mobile device. With 3rd party transaction importer software, the merchant downloads transactions much like downloading bank transactions. This software can be a one time fee, annual fee, or SaaS with recurring billing. Merchants with higher volume, multichannel, or needing special payment solutions can use this. Typically the software provides more control for importing, including matching to existing QB data.

- Process transactions within Quickbooks, using a 3rd party application. To reduce PCI Compliance burden, the merchant experience is that they’re in QB, but the payment activity is occurring via a 3rd party secure payment gateway, connected to a regular merchant account. The benefits are more control and flexibility, with the efficiency of working within Quickbooks and automatically marking invoices as paid etc. There’s nothing that Quickbooks does that cannot continue to be completed within Quickbooks with the integration, or that cannot be enhanced with the 3rd party integration, including electronic bill presentment and payment. Some differentiators for B2B include payment types supported (check, ACH, wire, credit card, Paypal and more); delivery methods- text, email, other, automated reminders- 30 days or on your schedule, cardholder authentication-3-D Secure shifts fraud liability to issuer. For any sizable business, efficiencies and cost savings will outweigh the costs of the gateway, solution, and merchant account fees.

Need help making the right choice? The best solution is not the same for every business. There are many factors including business type, how and where you accept payments, whether you have aging accounts receivable and more. Check processing was not covered here, but it’s the same concept.

Quick buying guides:

- If your business processes less than $100,000 annually, stick with whatever you have and focus on growing the business.

- If you don’t use Intuit merchant services now, and are key entering every record from your 3rd party processor, it’s worth exploring options.

- If you process $1,000,000 or more annually, the benefits are well worth the time to make a change. Call 954-942-0483 for a FREE consultation for a regular merchant account with Quickbooks integration. “I’ve used them all, and I’ve been a Quickbooks user for over 15 years,” says Christine Speedy, owner of 3D Merchant Services. “In about 5 minutes, I can ascertain whether it’s worth exploring alternatives, or give merchants peace of mind they have the right solution for their business.”

Do you have Pro pricing? Here’s an Intuit merchant services price comparison for business to business, for Visa, MasterCard, Discover.

Intuit merchant services:

3.15% Keyed

25¢ per transaction

10¢ AVS fee

15¢ non-qualified transaction (rewards, business, corporate, purchasing cards are all non-qualified)

$1000 Sale

$32 fees

$968 deposit

$100,000/mth total sales

$3200 fees paid dally

Regular merchant account- this is not a quote. It’s simply an example and merchants can pay more or less. The ‘bundled’ fees below includes everything from AVS to dues and assessments that a merchant might see on a merchant statement.

2.3% Average effective rate with all fees bundled for this example

30¢ per transaction with all fees bundled for this example

$1000 Sale

$23.30 fees

$976.70 deposit

$100,000/mth total sales

$2330 fees paid next month

$870/mth savings