Due to new credit card processing mandates effective October 14, 2017, business to business merchants especially need to review practices for card not present transactions. Compliance will boost profits and improve customer experience; non-compliance will increase costs, penalty fees and customer dissatisfaction. Our Quickbooks plugin for all desktop and enterprise versions (except Quickbooks Online) eases the burden of compliance, while improving customer buying experience, cash flow and profits. For business to business (B2B), we have the best solution.

Card Not Present Credit Card Processing Rules & Guidelines:

- Never store full card data on paper or digitally. If you can retrieve it, so can a criminal. Merchants are never, ever allowed to request the security code (Visa Core rule 5.4.2.5) on paper, or via digital methods such as email or text. Paper credit card authorization forms as well as digital signature forms that can be unencrypted to view sensitive cardholder data are prohibited. We fix this problem by delivering electronic invoices and empowering customers to self-store payment methods.

- When first storing a credit card, perform a Zero Dollar Authorization with the correct transaction type flag. This process is managed seamlessly in the background if supported and enabled by the payment gateway. (TIP: Some solutions perform a $1 authorization and then void the transaction- this is non-compliant.) We automate this this process in full compliance.

- Perform Cardholder Authentication. The two authentication options are card security code and 3-D secure, such as Verified by Visa. The latter is a global standard that requires the cardholder self-initiate payment, a more secure solution; Merchants using 3-D secure benefit by increased sale approvals, fraud liability shift to issuers, and for some cards, lower rates.

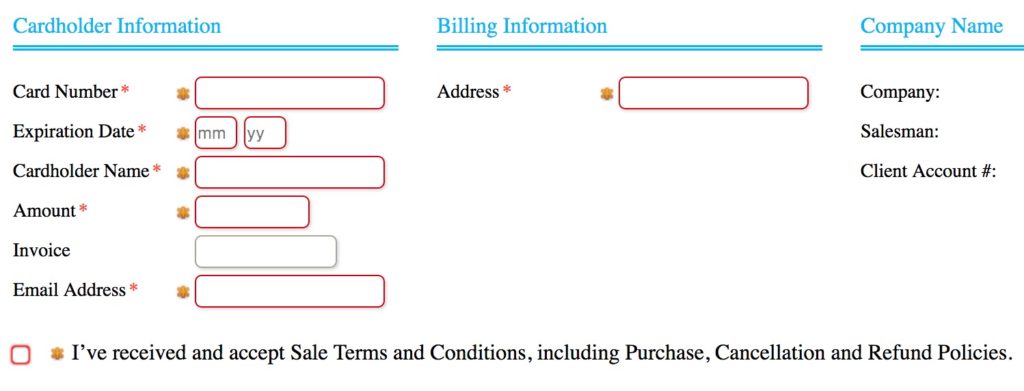

- When first storing a credit card, have your customer opt-in via a manual checkbox to return and cancellation policies.

If your gateway does not include this option for customer initiated checkout, including paying invoices, it’s an easy way to identify your payment gateway is not compliant with new rules yet.

- Use a payment gateway that supports new authorization rules, including stored card pre-authorization, incremental authorization, final authorization, authorization reversal, partial authorization reversal, and credit authorization.

Both the payment gateway provider and processor must support 3-D secure and zero dollar authorization.

Alternative Quickbooks Credit Card Processing Module- features for card not present:

- EBPP- Electronic Bill Presentment and Payment to send invoices and accept ACH/eCheck, credit card, wire, Paypal

- Customers self-manage payment methods

- Unscheduled charge card on file supported

- 3-D Secure and additional security tweaks

- Customer portal for 24/7 invoice retrieval and payments

- Deliver invoices via text and email

- Automated collections reminders

- Opt-in checkbox with custom text

- Optional custom fields

- Works with all the acquirers, including First Data, Paymentech, Heartland, Global Payments, Elavon, TSYS, Moneris etc.

- Level III 3 processing supported for reduced merchant fees when applicable for purchasing, business and corporate cards.

- Smart Rate selector optimizes transactions for lowest qualified rate

Want the best Quickbooks credit card processing plugin for your B2B business? Contact Christine Speedy today for a virtually instant ROI, maximize profits and cash flow while improving your customer buying experience. Quick and easy to adopt, you’ll wish you had found this solution sooner.

Christine Speedy, CenPOS authorized reseller, 954-942-0483 is based out of South Florida and NY. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.