Compliance is not just about payment security. Each card brand has a set of rules for payment processing. Follow them and get rewarded with increased authorizations, reduced fraud risk, and lower merchant fees. The cost of non-compliance is heavy and getting worse.

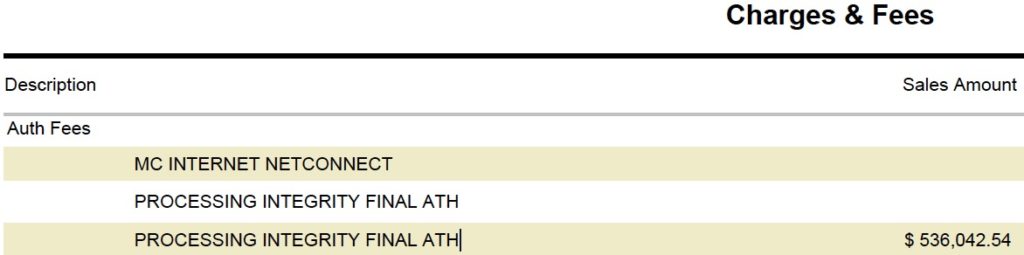

Look at this MasterCard PROCESSING INTEGRITY FINAL ATH Fee on a recent Chase Paymentech merchant statement.

Over $536,000 multiplied by .25% penalty fee for a total of $1,340.10 in avoidable costs. This is due to not properly authorizing and settling transactions, including reversals for unused authorizations. It’s too complicated to get into why this happens, but I’ve written multiple articles related to authorization validity, including one about the Visa Stored Credential Mandate.

Over $536,000 multiplied by .25% penalty fee for a total of $1,340.10 in avoidable costs. This is due to not properly authorizing and settling transactions, including reversals for unused authorizations. It’s too complicated to get into why this happens, but I’ve written multiple articles related to authorization validity, including one about the Visa Stored Credential Mandate.

The new fee of 0.25%, minimum $0.04 is assessed for each approved final authorization when*:

- Authorization expired. The Final Authorization transaction is not cleared within 7 calendar days of authorization date, nor has it been fully reversed.

- Authorization mismatch. The Final Authorization amount does not equal the clearing amount.

- Unused Authorization. The Final Authorization transaction did not clear and full authorization reversal was not submitted. What’s really painful about this one, is if an order is cancelled, you can lose .25% of the transaction amount so you lost money not making a sale!

- Final authorization currency code does not match the clearing currency code.

How can merchants avoid the MasterCard Processing Integrity fee?

Technology to manage the authorization and settlement process is the only way. Leaving it up to employees to figure out when an authorization is expiring and when a reversal is needed is a recipe for compliance fees like the above. Plus, chances are whatever system they’re using doesn’t even support the required data messages that need to go with the transaction.

The payment gateway plays a crucial role in authorization validity. A common misconception is that using a popular gateway, or even one owned by a card brand, or acquirer, will automatically get your transactions compliant. That is not the case.

I have extensive knowledge of many payment gateways. In my opinion, the CenPOS cloud commerce platform with suite of business solutions, including payment gateway, offers the best tools to automate authorization validity so you can avoid the MasterCard processing integrity final authorization fee as well as other penalty fees and assessments by multiple card brands.

Source: MasterCard Transaction Processing Rules 28 June 2018 TPR, Wells Fargo Payment Network Pass-Through Fee Schedule April 2016.

Christine Speedy, CenPOS Global Sales, 954-942-0483 is based out of South Florida, near Fort Lauderdale, and Rochester, NY. CenPOS is an integrated commerce technology platform driving innovative, omnichannel solutions tailored to meet a merchant’s market needs. Providing a single point of integration, the CenPOS platform combines payment, commerce and value-added functionality enabling merchants to transform their commerce experience, eliminate the need to manage complex integrations, reduce the burden of accepting payments and create deeper customer relationships.