Need a solution for level 3 processing with your First Data merchant account? A payment gateway that supports level 3 processing is required, but that’s not enough. Payment gateway selection and implementation impact whether a transaction actually qualifies for level 3 rates.

The main requirements to qualify for level III interchange rates are:

- Submit required extra order detail. This varies by card brand; for example Ship to/from ZIP code, Destination country code,VA/ tax amount, invoice number, order reference number, Discount amount, Freight/shipping amount, Duty amount, Order date, unit of measure and more.

- Valid authorization. For example, the authorization and settlement amount must be the same.

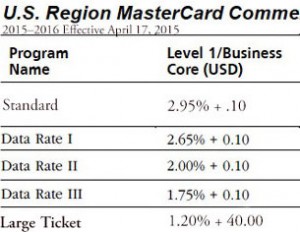

- Interchange Rate Special Requirements, which may vary by card, industry etc. For example, here are requirements to qualify for MasterCard Data Rate III

- U.S. Merchant

- Applicable Electronic Authorization Data must be included and match Settlement Data

- Valid Banknet Reference Number and Banknet Date in valid date format MMDD

- Settlement within 2 days of transaction

- Level II & Level III Corporate Card data (Level II Data includes the entry of customer code, card acceptor type, tax ID and sales tax. Level III Data includes Level II data, line item detail, item description, item quantity, item unit of measure, extended item amount, product code, and debit or credit indicator.)

- Non-T&E MCC

- Card Acceptor Type and Tax ID must be provided

Visa Stored Credential Framework Impacts Authorization Validity

For business, corporate and purchasing card transactions to qualify for Level 3 interchange rates, a valid authorization is required. New rules change requirements for card not present transactions using stored cards. US businesses must comply with Visa Stored Credential Transaction framework effective October 14, 2017. Without getting into too much detail, payment gateways must update to comply, and merchants will also need to make some changes going forward.

Merchant requirements include:

- When capturing a stored credential for the first time, complete special requirements, including cardholder authentication as applicable (Managed by payment gateway or integrated solution.)

- Send correct transaction type on subsequent transactions: Installment Payments, Recurring Payments, or Unscheduled Credential On File. (Managed by payment gateway or integrated solution.)

- Authorization and settlement amount must match. (Managed by payment gateway or integrated solution.)

- Obtain cardholder consent and disclosure agreement. (Most likely managed by payment gateway or merchant.)

For years, authorization and settlement amount mismatch has been a common problem for merchants to qualify for level III rates. Even if a gateway solves this problem, an integration may limit the capability. This is easily identified by EIRF, STD/ standard, level I and level II rates present in the “pending interchange” section on merchant statements.

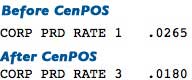

To solve all of the above problems, merchants can use a third party payment gateway with their merchant account, that manages authorization validity and continual changes within the gateway, including integrated solutions. Below image shows before and after interchange rates from actual merchant statements; same merchant account, just changed the payment gateway. Contact Christine for a level 3 payment gateway that works with your First Data Merchant Account, as well as other acquirers.

Contact Christine for a level 3 payment gateway that works with your First Data Merchant Account, as well as other acquirers.

Christine Speedy, CenPOS authorized reseller, 954-942-0483 is based out of South Florida and NY. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.