I’m advising my CenPOS clients with card not present transactions to use either the hosted pay page or Electronic Bill Presentment and Payment (EBPP), also known as electronic invoice presentment and payment (EIPP) due to increasingly complex rules. Plus cardholders are weary about giving out card data over the phone, and paper or digital credit card authorization forms should be abolished. Reducing friction to collect payments, while putting cardholders in control of their data, is proven to increase sales, profits and cashflow so updating procedures is a win win for you and your customers.

What is a hosted pay page?

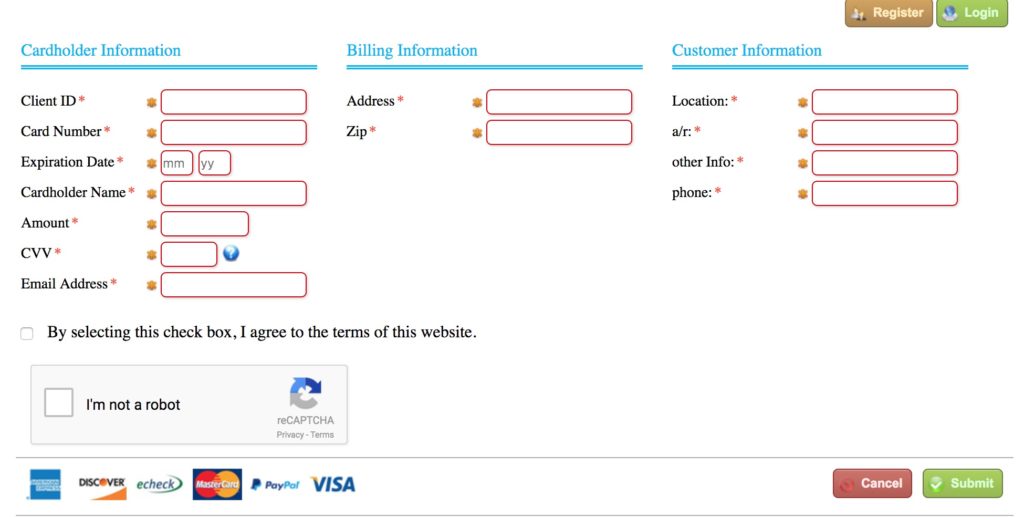

A hosted pay enables customers to passively pay bills online via a secure web page hosted on a CenPOS server. The form can be embedded on your web site secured with an SSL certificate or you can direct customers to your custom CenPOS URL. The most common payment types CenPOS users enable are credit cards, Paypal, and ACH (echeck).

- The burden for completing data fields to make a payment is on your customer.

- Customers can optionally create an account and store and manage all payment methods.

- Depending on your customer agreement, either you or the customer can use a stored token on file to initiate future transactions.

- Customers can view prior payment history, but not actual invoices.

What is EBPP?

With EBPP, the payment request is delivered to the customer via email or text. The message includes a custom link to pay a specific bill or invoice and some of the fields are pre-filled. Customers prefer EBPP vs hosted pay page. The most common payment types CenPOS users enable are credit cards, Paypal, ACH (echeck) and wire transfer. The last is very important for international businesses to streamline bank reconciliation and match deposits to invoices.

- Data fields, including invoice number and amount, are pre-filled to save your customer time.

- Customers can optionally create an account to store card data, pay multiple invoices, review payment and invoice history in the CenPOS hosted portal.

- Depending on your agreement with your customer, either you or the customer can use a stored token on file to initiate future transactions.

- With a CenPOS ERP or accounting software integration, your records are automatically updated with payments, and reminders are automatically delivered.

- Optional 2-way texting service has many benefits, including communicating with customers via their preferred methods- whether phone, text or email.

What are the benefits of customer initiated payments with hosted pay page or EBPP?

- Increased efficiency to comply with new stored credential rules.

- Reduced merchant fees for some cards (3-D Secure cardholder authentication must be enabled.)

- Increased approvals with cardholder authentication.

- Mitigate chargeback risk – with cardholder authentication fraud liability shifts to issuer.

In summary, either method of online payments increases security and enables customers to pay 24/7 to increase cash flow. EBPP solutions have significant additional benefits and the cost to implement is virtually nil, with many businesses experiencing an instant ROI.

Christine Speedy, CenPOS authorized reseller, 954-942-0483. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant’s banking relationships.