Accepting credit card deposits for events requires compliance with both card not present and stored card rules. Not PCI Compliance rules for data security, but rather authorization rules set by Visa, MasterCard etc. Comply with the rules and get rewarded with more authorization approvals, qualify for lower rates and mitigate risk of chargebacks.

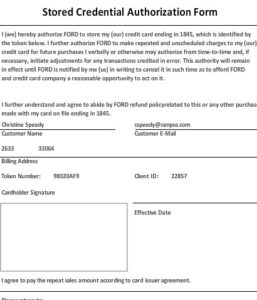

Professionalism starts on the phone and continues throughout the buying experience. By replacing traditional credit card authorization forms with technology that puts buyers in control of their cardholder data, merchants create a better buying experience. Traditional credit card authorization forms were created to establish a record to use in the event of a future dispute. They’re useless today.

Merchants must replace credit card authorization forms with technology compliant with new rules for storing and using stored cards.

- The initial authorization authenticates the cardholder.

- The initial authorization informs that the cardholder has agreed to merchant storing card.

- The transaction type will indicate it’s an estimate.

- Future authorizations will reference any required above items and be submitted as Incremental or Final.

Compliance with the above is not possible with desktop terminals and even most virtual terminals and payment gateways. Merchants need a virtual terminal and or payment gateway that supports Unscheduled Credential On File, Incremental and Final Authorization rules. This is new terminology and new fields in the transaction process.

“Don’t be surprised if vendors don’t know about or support these rules. Just like EMV chip rollout, it’s a huge change and few providers are keeping up. We’re an exception. I had solutions for my clients prior to the EMV shift in October 2015 and again for the 2017 stored card mandate.”

Christine Speedy

Our solutions reduce buyer friction to pay and enables event sales and back office staff to collect deposits and capture cardholder data via text or email. These include push out payment requests via text or email, capture cardholder data for later use, and upload an invoice to collect payment.

Benefits of compliant solution:

- Reduced merchant fees even with the same merchant account.

- Increased approvals with cardholder authentication.

- Mitigate chargeback risk including fraud liability shifting to issuer.

- More convenient for buyers- 24/7 payments on their schedule, not yours.

- Buyers are in control of choosing to store payment methods

Call Christine Speedy, PCI Council QIR certified, for simple solutions to card not present payment transaction problems, 954-942-0483, 9-5 ET. The cloud technology you need today to accept all payment types, with optional merchant, check processing and other services.

#hotel #creditcardauthorization