Popular Industry Association Business Service Partners Fail To Keep Up With Changing Payment Needs

December 7, 2015– Wholesale distributors may rely on association negotiated payment processing for reduced rates, but associations are admittedly not payment experts. In fact, other than comparing rates on paper, that lack of expertise and or lack of desire to make a change, could result in compressed profits as we head into 2016 and beyond. EMV chip card acceptance affects both retail and card present businesses.

“The EMV chip card terminal directly impacts interchange rate qualification, and none of the most popular terminals recommended today meet critical wholesale distributor requirements,” says Christine Speedy, B2B payments expert.

Why? Managing the entire payment process is crucial to impact the biggest component of fees – card interchange. Interchange rates are non-negotiable, but they can be influenced. There are hundreds of fees that can be tacked on based on each transaction type. Due to complexities, distributors must have an intelligent solution to manage the payment process and ensure compliance with all the rules.

PURCHASING CARDS

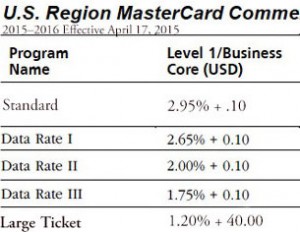

To qualify for the lowest interchange rates, transactions must meet all the rules for the specific card and transaction method. For distributors, processing level III data for Corporate, Purchasing, and Business cards is critical. Their card use is growing and savings of 90 basis points or more for some cards is an attractive margin difference worth achieving.

Sample interchange rates for the same credit card transaction; Failing to follow rules results in costly extra fees.

Countertop terminals like the popular First Data FD Series, Verifone VX series, or Ingenico iCT series, with downloaded programming, cannot support level III. The US EMV ecosystem requires a web-based payment gateway with EMV terminal and level III retail certification. For example, CenPOS has certified the Verifone MX915 to First Data, Chase Paymentech and Tsys, the latter which enables use with most processors. Merchants can use CenPOS via a web browser virtually instantly or an integrated application.

EMV COMPLIANCE DATES

While EMV is not a mandate, effective October 1, the party that does not support EMV (short for Europay, MasterCard, Visa) chip card acceptance is liable for counterfeit card, and sometimes lost or stolen card transactions. Because card issuers previously absorbed most of these losses without any notification to the merchant, businesses can expect losses if action is not taken. Additionally, non-EMV compliance fees have already been announced with at least one provider, NPC, implementing them starting January 1, 2016.

CARD NOT PRESENT

Many distributors primarily accept payments via other methods, including card not present (CNP) credit card. With CNP fraud already climbing for wholesalers, it’s only going to get worse. Implementing 3-D Secure (Vbyv / Verified by Visa and others) shifts some fraud liability from the merchant to the issuer. This service is available only via certain gateways and can only be used when the customer pays online via a shopping cart, einvoice, or paypage. Distributors may need to change their payment methods to maximize protection against fraud.

RECOMMENDATION

Wholesale distributors need to partner with a payments expert to mitigate risk as well as manage interchange rate qualification. Selecting vendors based on new criteria can increase profits virtually overnight.

Christine Speedy, CenPOS global sales and integrated solutions reseller, 954-942-0483. CenPOS is a merchant-centric, end-to-end payments engine that drives enterprise-class solutions for businesses, saving them time and money, while improving their customer engagement. CenPOS? secure, cloud-based solution optimizes acceptance for all payment types across multiple channels without disrupting the merchant?s banking relationships.